How to Open An Account With Wealthsimple and Get a Sign up Bonus

I’m really excited to announce a new special offer for Family Money Plan readers (that’s you!). If you are looking for an easy way to get started investing I have teamed up with Wealthsimple. When you sign up with Wealthsimple using this link they will give you your first $10,000 managed free for 1 year to start investing.

What is Wealthsimple?

Wealthsimple is an online professional investing service in both US and Canada, also referred to as a robo-advisor . They use low cost index fees and smart technology to keep your investment costs low. Instead of trying to beat the market they invest in the market as a whole. This diversification allows you to avoid putting all your eggs into one stock and can smooth out your returns and minimize your losses.

Who Wealthsimple for?

Wealthsimple is for people who are investing for the long term. It’s best for people who are contributing regularly to their investments (remember you should be doing some investing for your future every month) commonly known as dollar cost averaging. This is when you are putting in money on a regular on-going basis.

What is a Robo Advisor?

Wealthsimple is a robo advisor. What that means is that they are an online automated service. They use algorithm-based portfolio management rather than using one individual to pick investments for you. This means lower costs but still able to get professionally managed portfolio.

But don’t worry, you can always call and speak to a real human being at Wealthsimple. I’ve been fortunate enough to go to their Toronto HQ and the staff there are great!

Why choose Wealthsimple?

- 0.5% Fee on your account up to $100,000 and then it drops to 0.4%

- You can call, text, or email for help or money advice and speak with a real person for free (believe it or not other places charge for this)

- Automatic dividend reinvesting and portfolio rebalancing. Both of these are great if you have ever managed your own money you know the benefit of having someone else do this.

- They are backed by Power Financial Corporation, one of the worlds most highly ranked institutions.

- SIPC insured for coverage up to $500,000 (and $1,000,000 CIPF insured in Canada)

- Low fees, they use ETFs to create the right portfolio for you based on your needs. The ETFs are also registered in your name so there is no concern should Wealthsimple decide to close their doors.

- Everything is encrypted. They use 128 bit encryption on all their software. The same as all big banks.

The best part about Wealthsimple

It’s so easy to get started. You can do it all online and you don’t have to go in anywhere and sign papers. It’s great. I signed up and it took me under 5 minutes. The whole time I was sitting on my couch! If you want to get your bonus of your first $10,000 managed free for one year, you can sign up using this link. There’s no account minimums. So there is literally no reason to not give this a try.

If you prefer you can watch the video here I walk through an RRSP, but they are all the same no matter which account type you open.

(Honestly, by the time you read through this you could already have set up your account and got your bonus. If you want to jump right in you can go to the bonus here.)

Let’s do this!

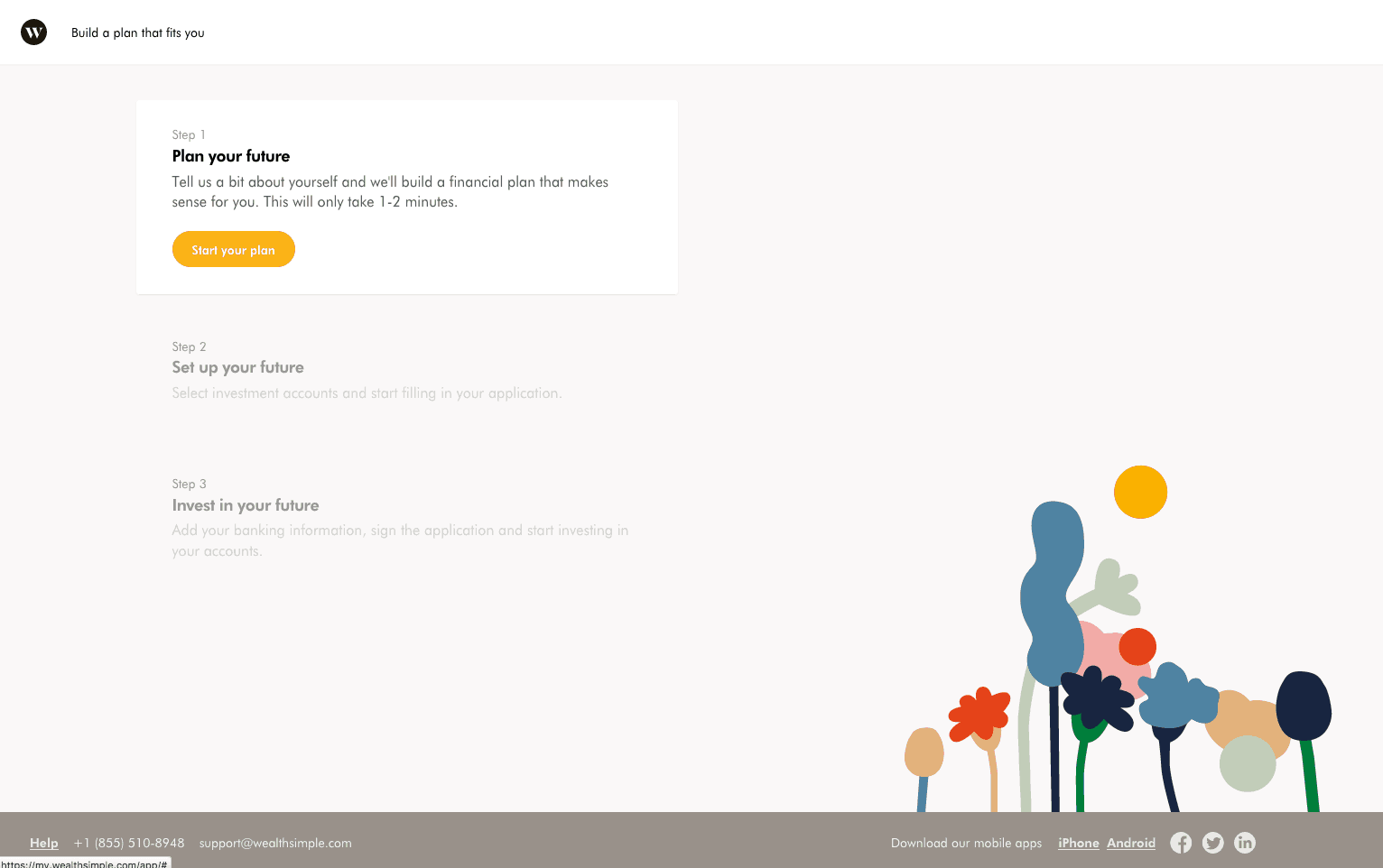

First is to click on this link to get your sign up bonus in your Wealthsimple account. Then click on “Get Started”

Next you will click on Step 1 of 3 Start Your Plan.

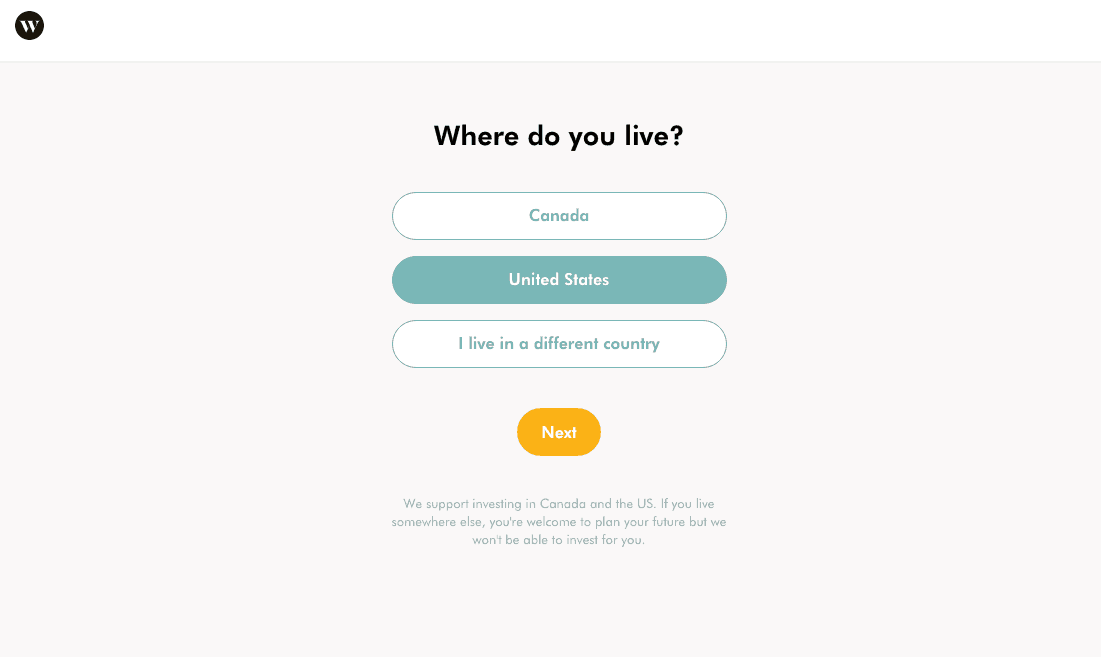

Wealthsimple is currently only available in the US and Canada. Select your country and move on.

The next step is to answer where do you live. Simple!

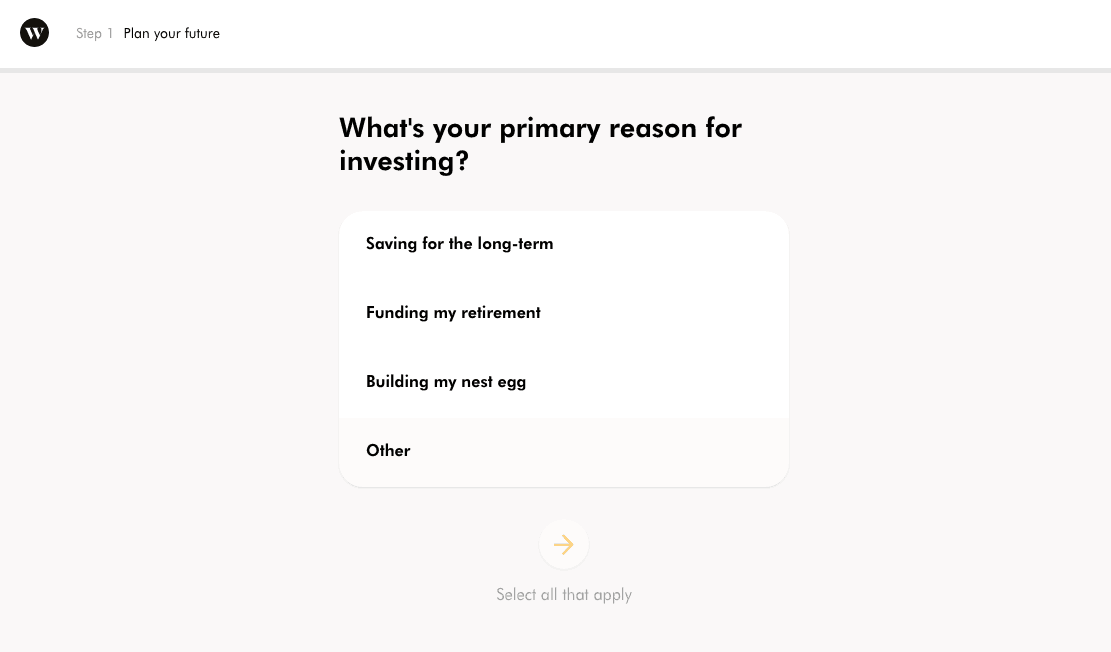

Next Question: What’s your annual income?

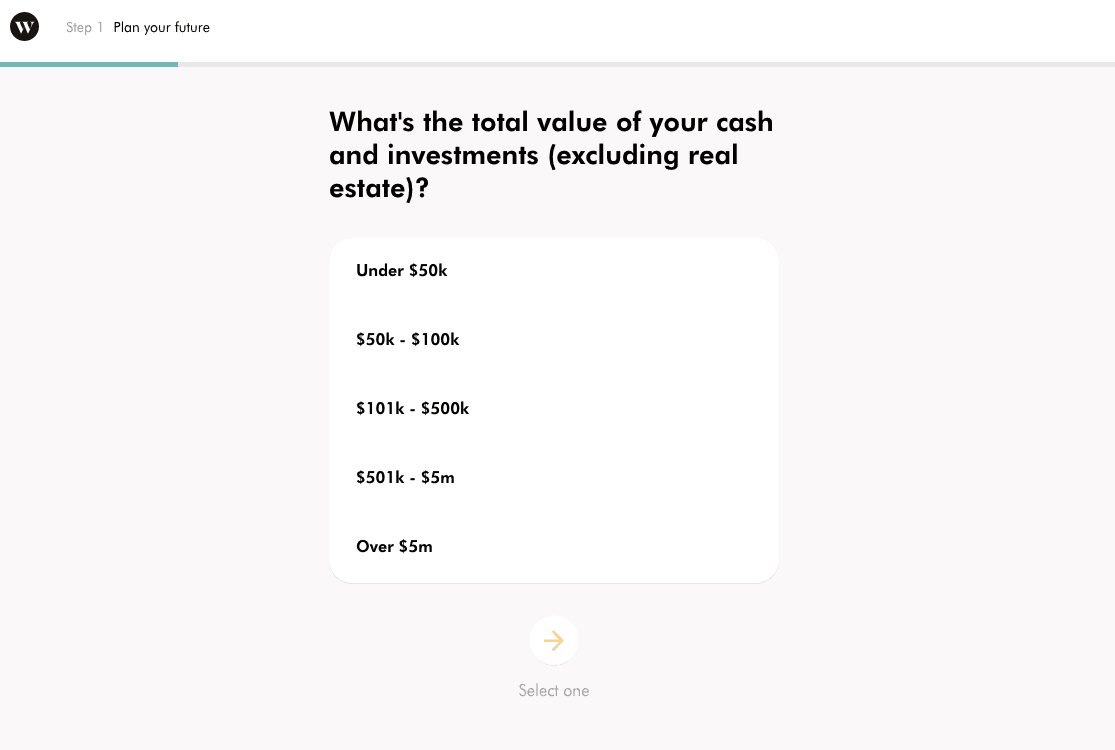

What’s the total value of your cash and investments (excluding real estate)?

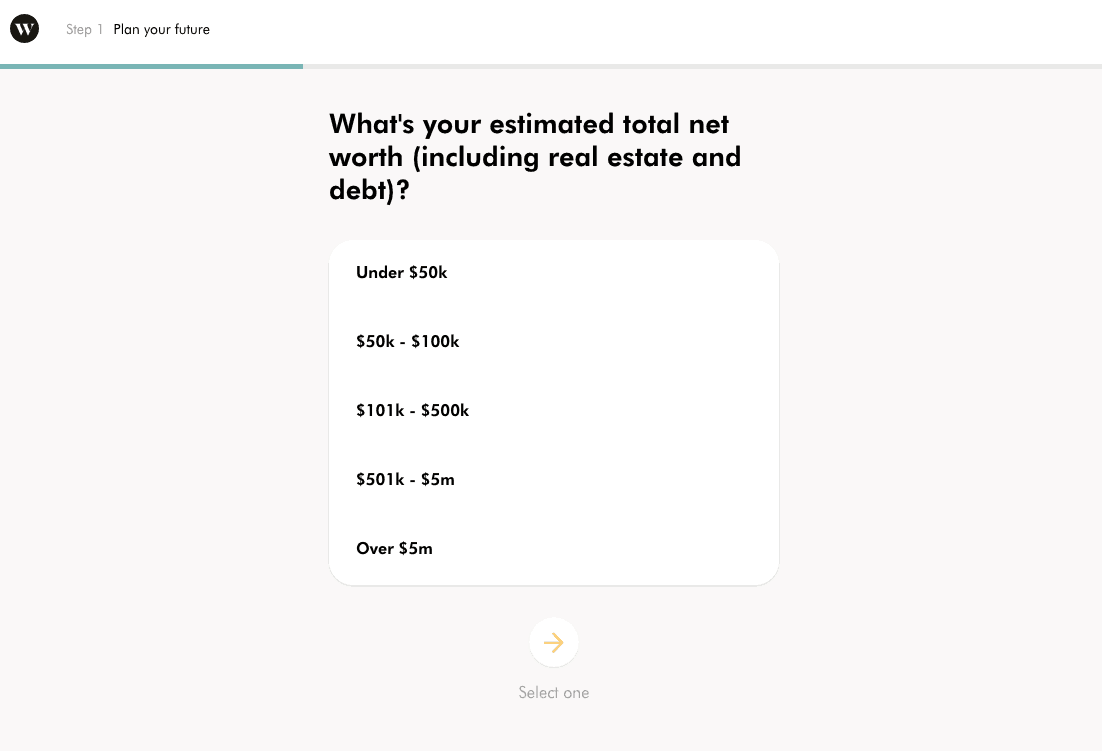

What’s your estimated total net worth (i.e. everything you own less everything you owe)

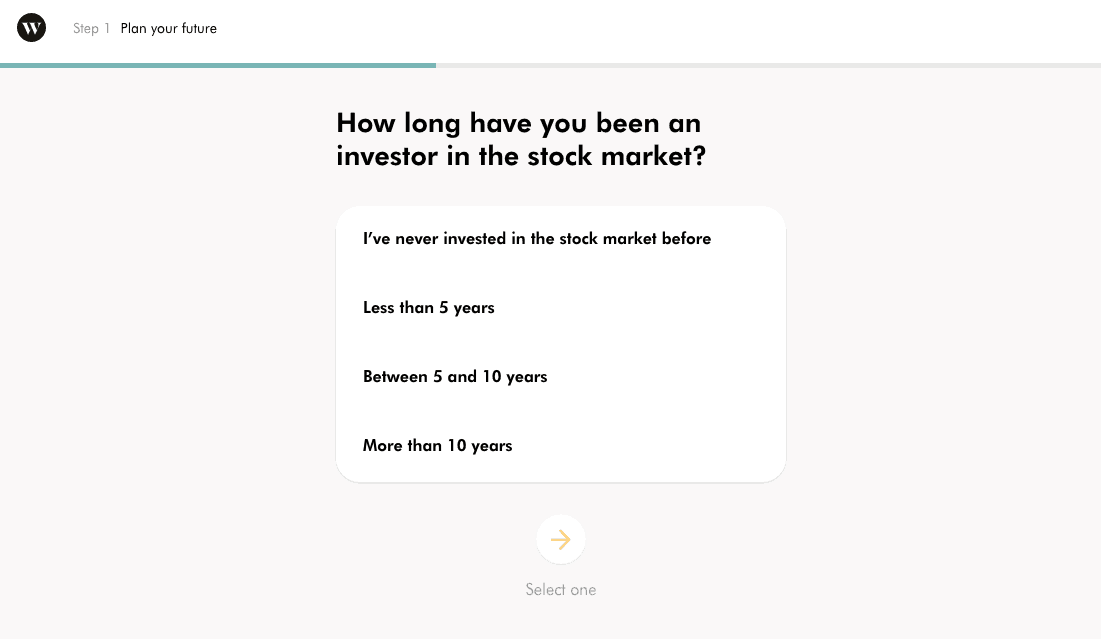

How long have you been an investor in the stock market?

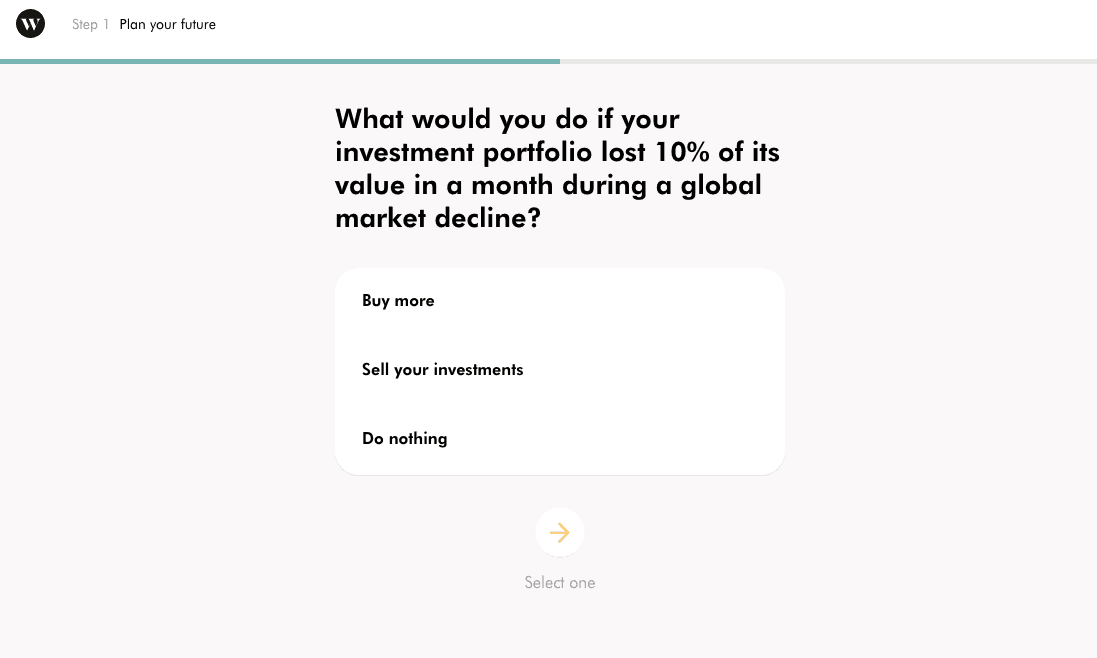

What would you do if your investment portfolio lost 10% of it’s value in a month during a global market decline?

This is getting an idea of your risk tolerance, it’s important to know how you would really react, versus what you think is the right answer. The right answer is the one you would actually do.

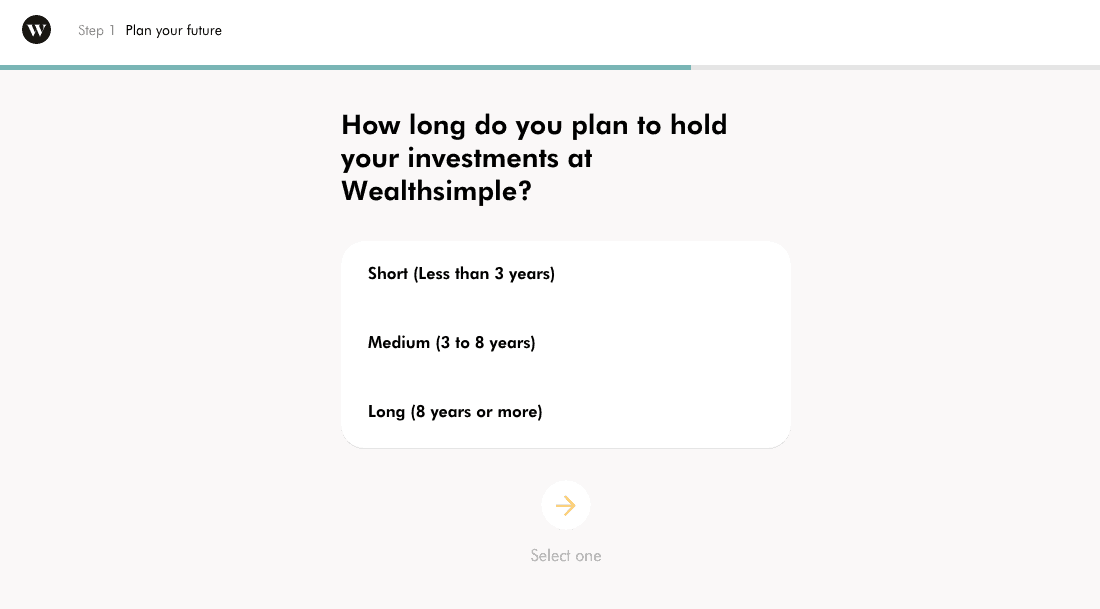

How long to you plan to hold your investments at Wealthsimple?

Since Wealthsimple is a long-term investing approach, they need to get an idea of your investment timeline. How long you hold your investments is a very important part of investing.

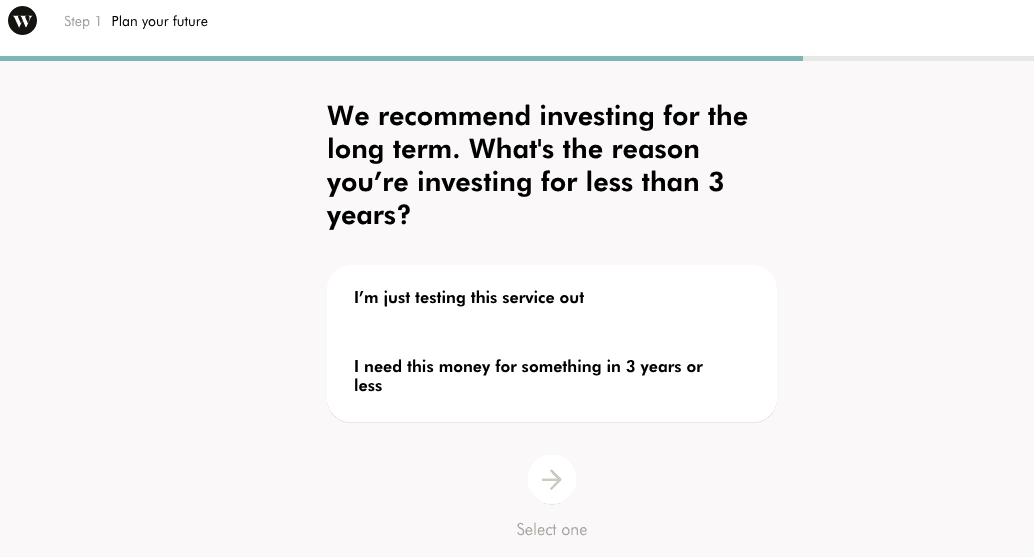

And if you answer 3 years or less, that’s cool, they just want to know why?

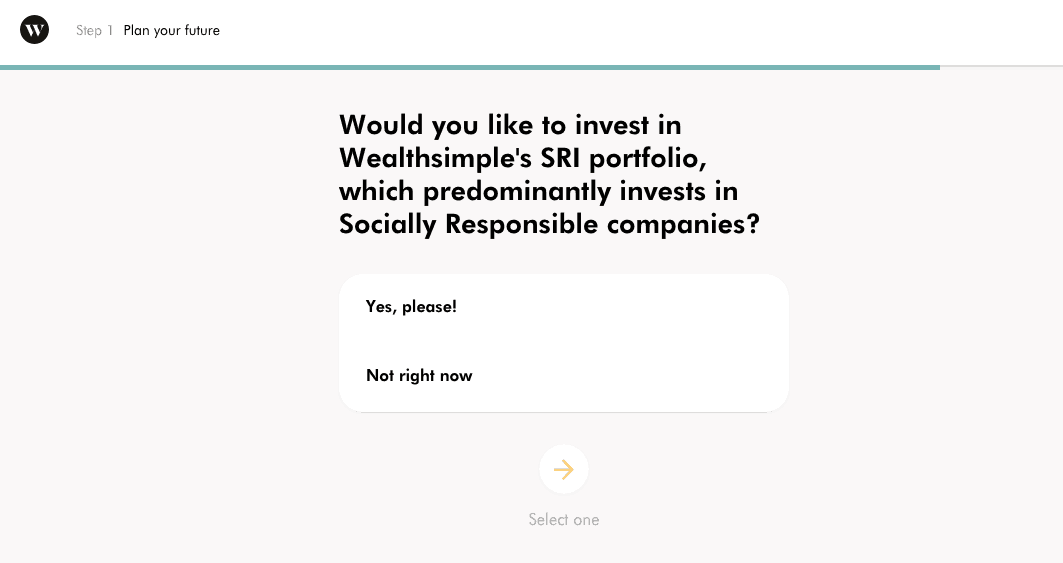

Would you like to invest in Wealthsimple’s SRI portfolio?

If you are interested in investing in Socially Responsible companies, Wealthsimple has created a portfolio to match that need.

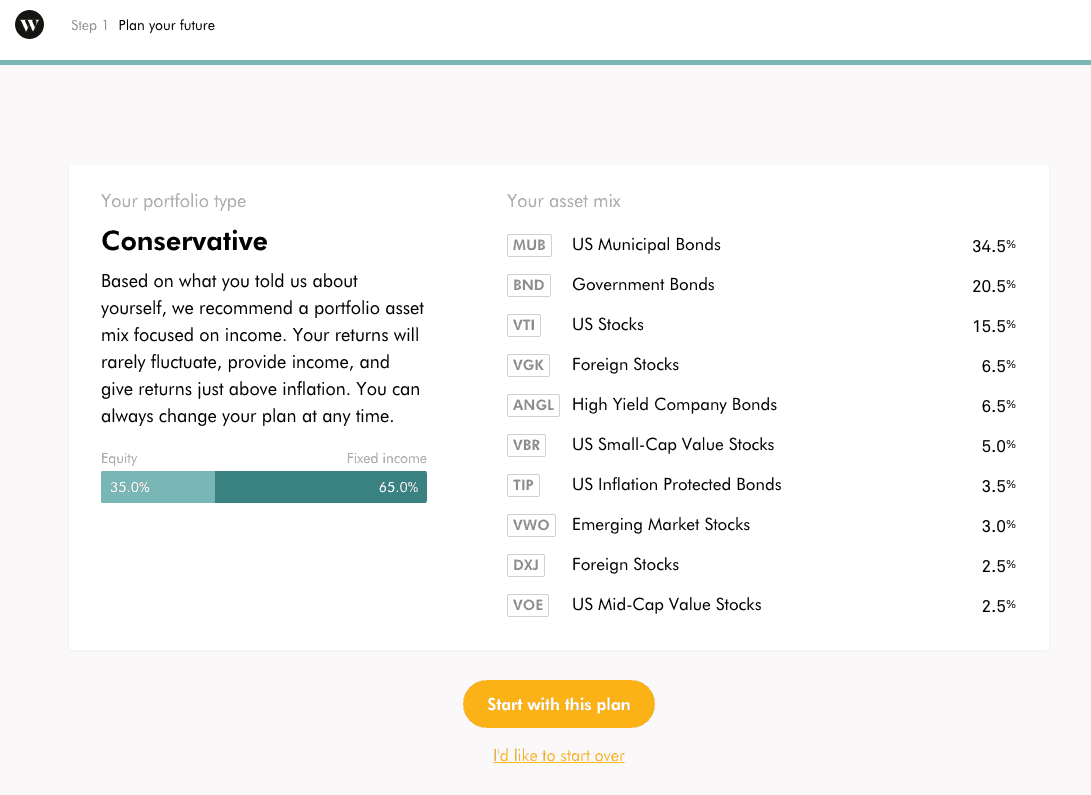

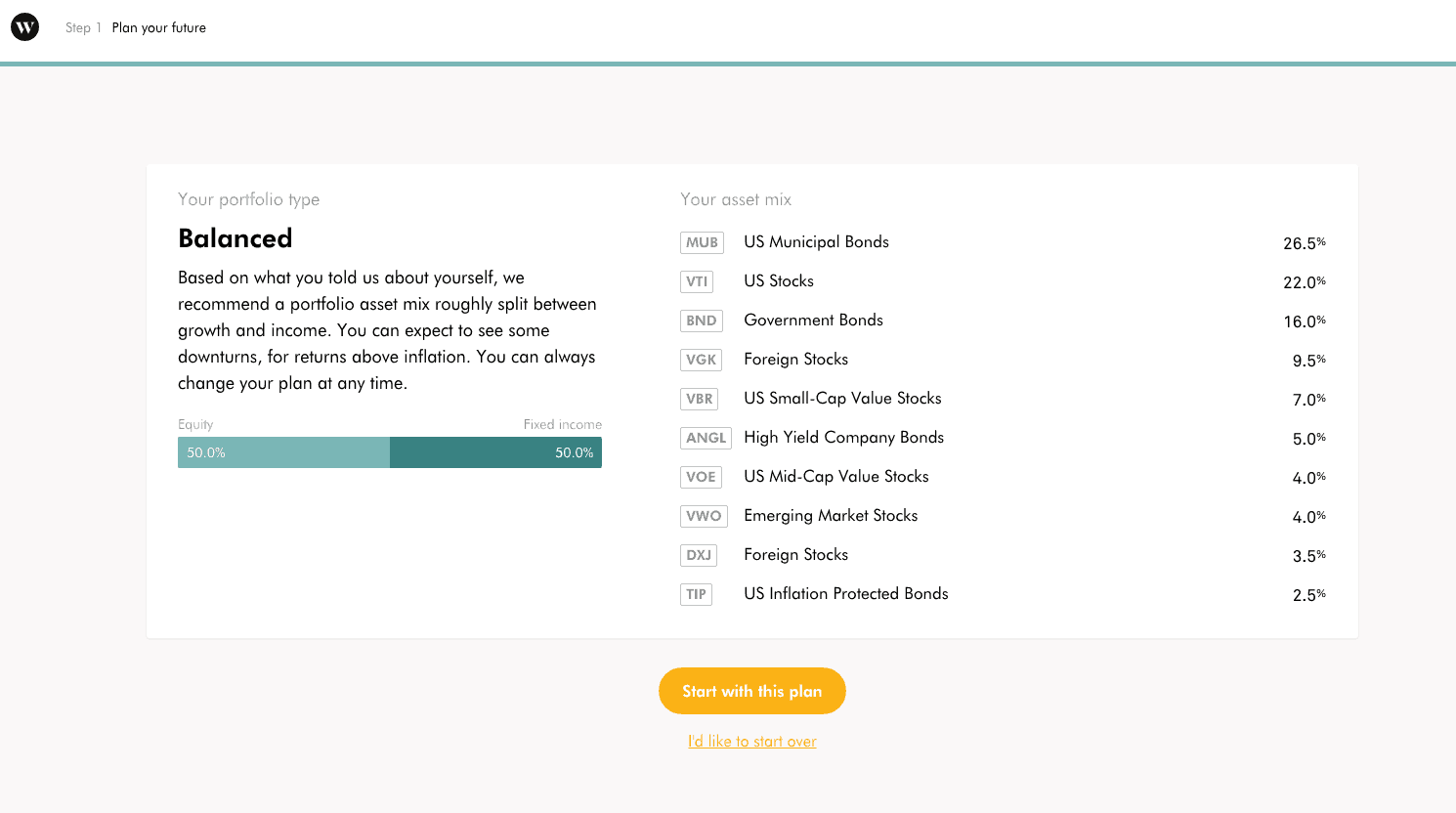

And the portfoio is…. (drumroll)… Conservative. There are a bunch of different portfolios (Balanced, Growth, Conservative) to chose from.

You can always change it, assuming you have answered everything honestly we can set up our account.

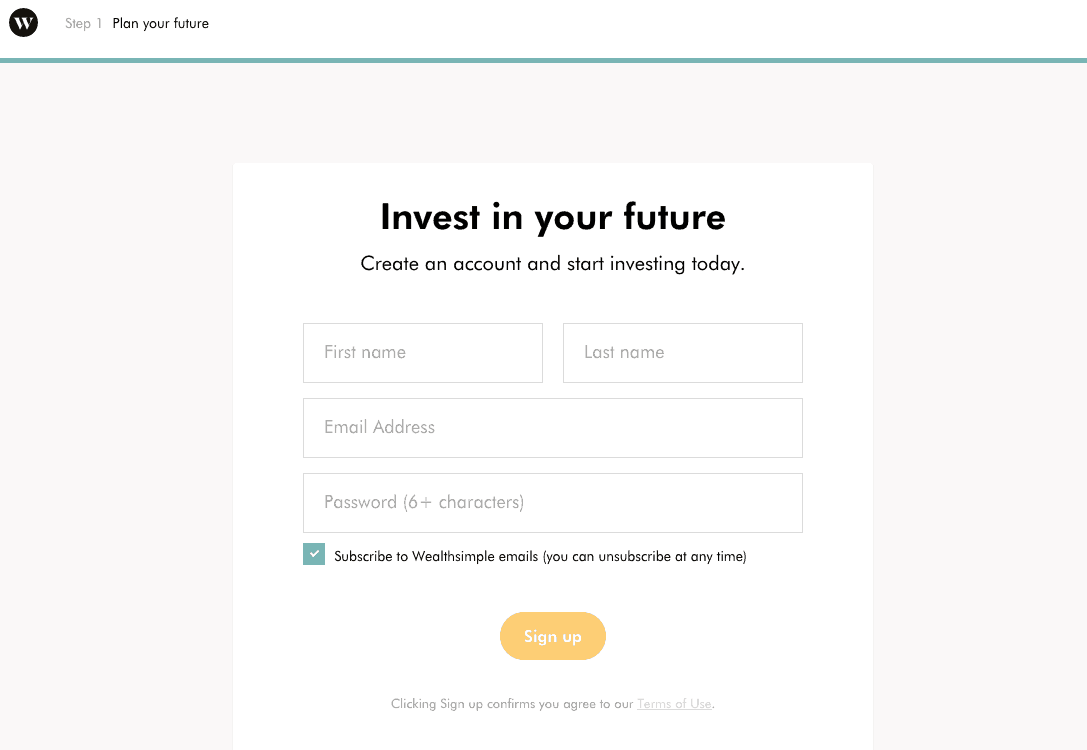

Setup your Account

Simply enter your name, email and password and you are ready to move on to Step 2

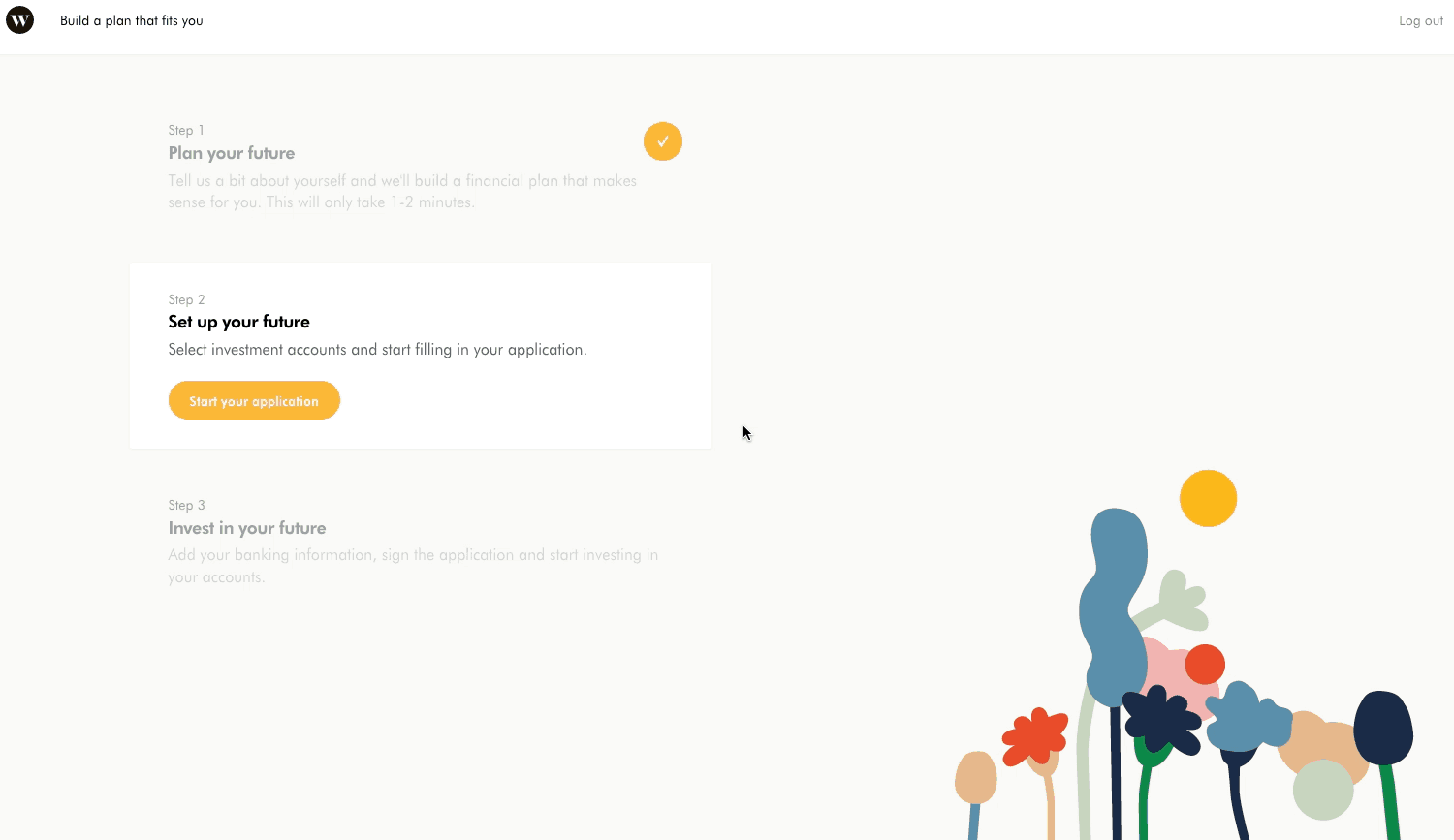

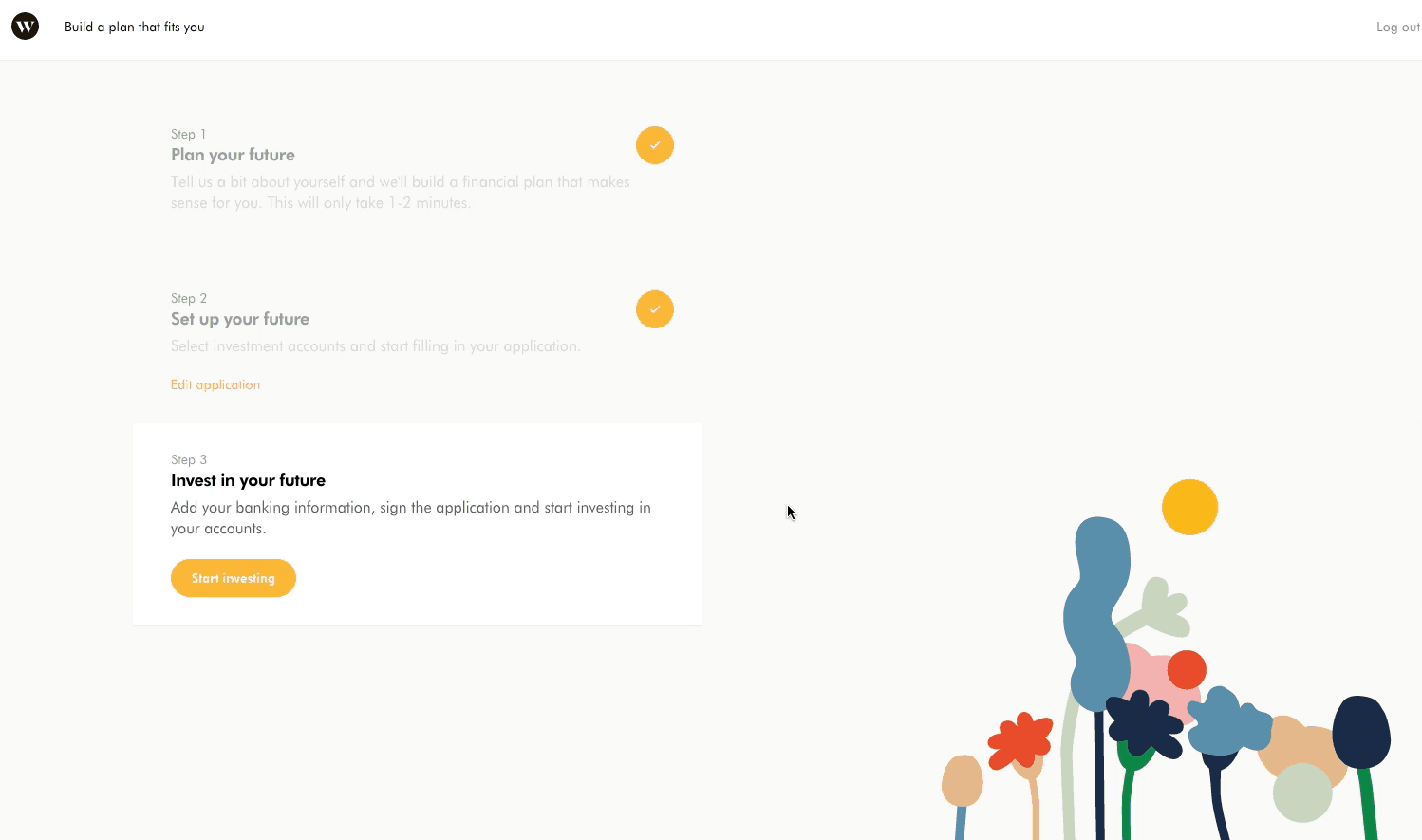

Step 2: Set up your future

In this part you will be logged in and entering your personal information to get started investing.

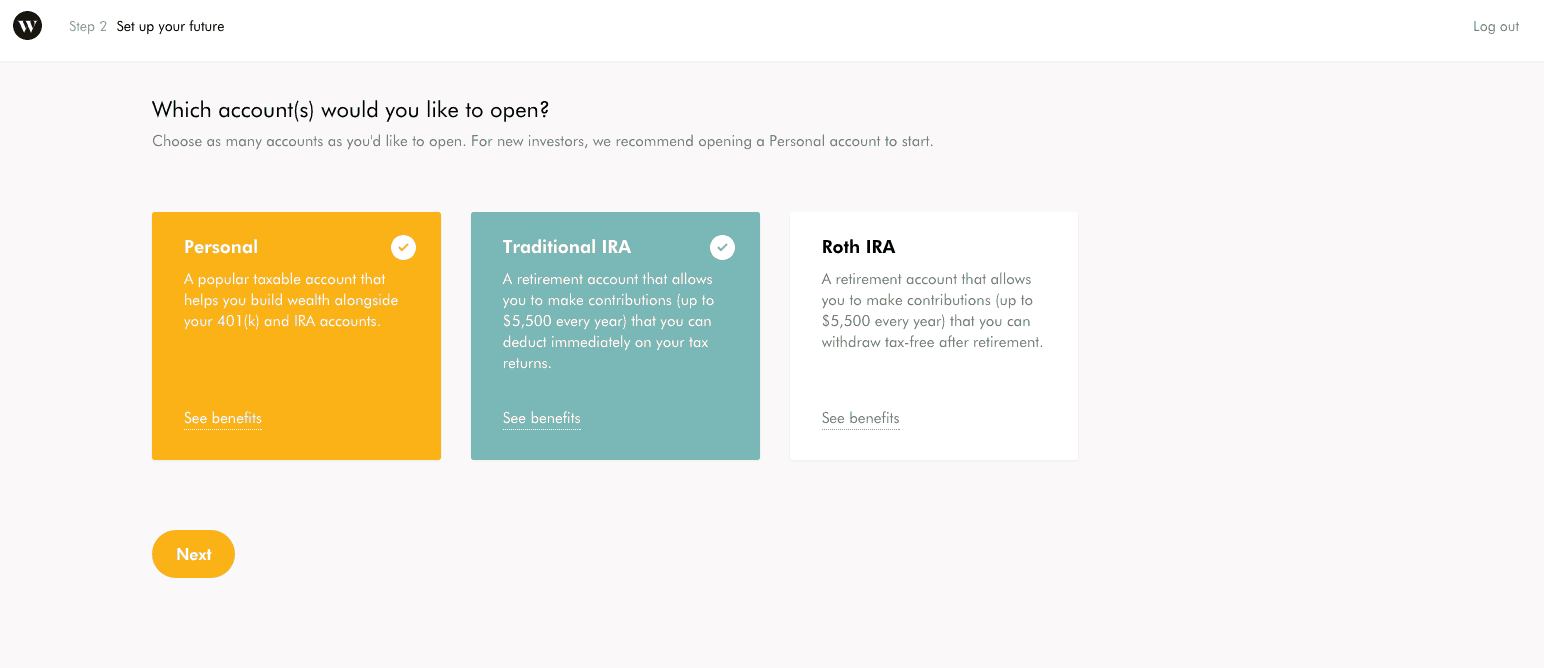

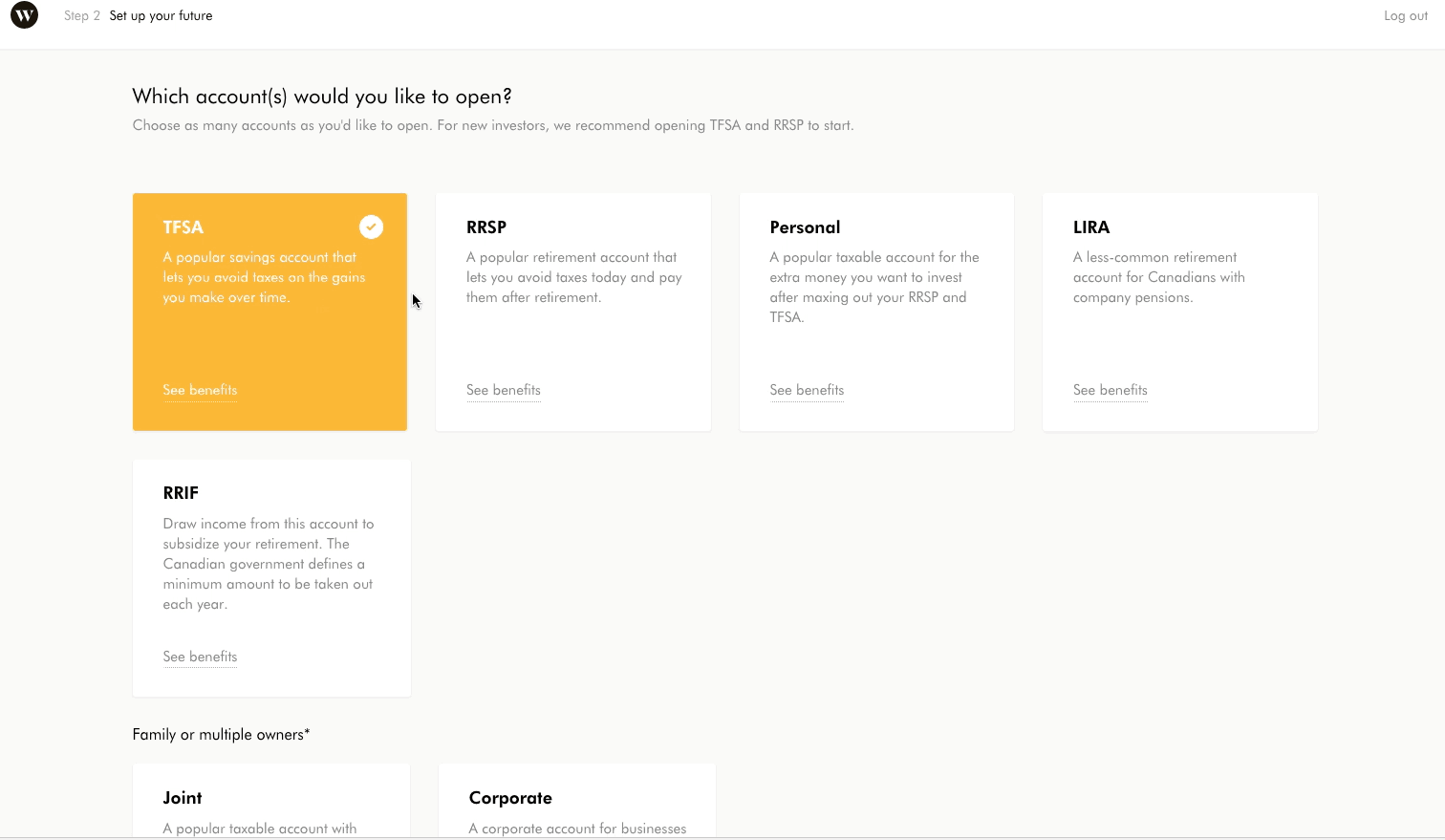

Which Account Would You Like to Open ?

Here you can select the different accounts you would like to open with Wealthsimple

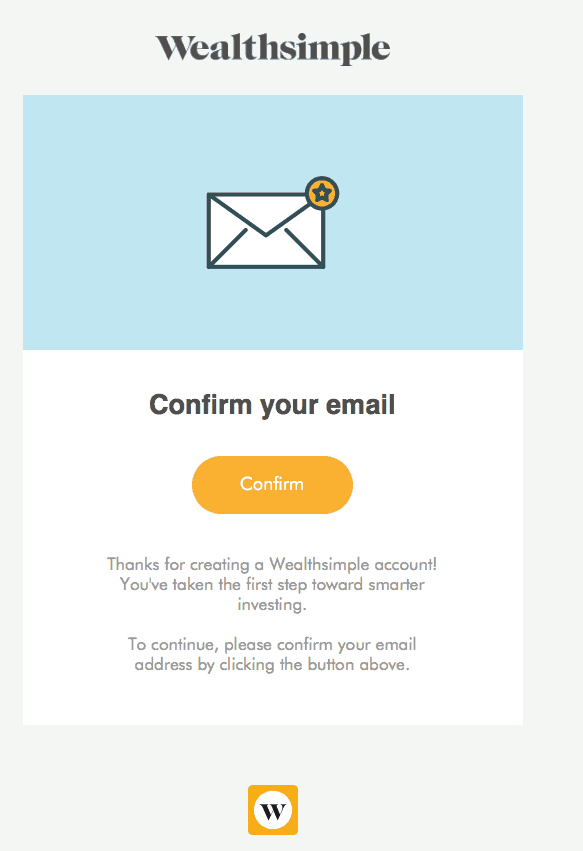

You will also get an email to confirm the email you signed up with.

Just go ahead and click on the link.

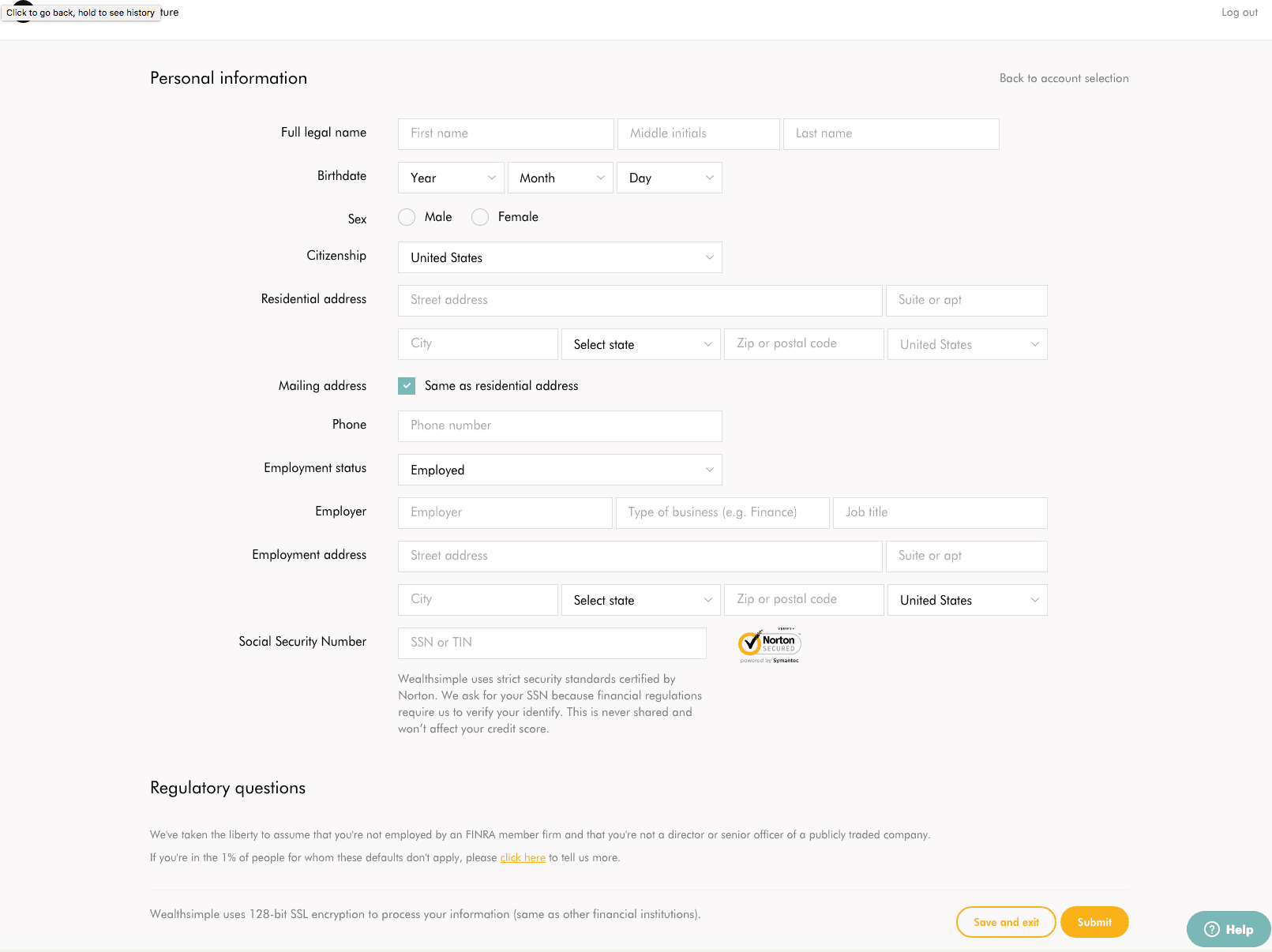

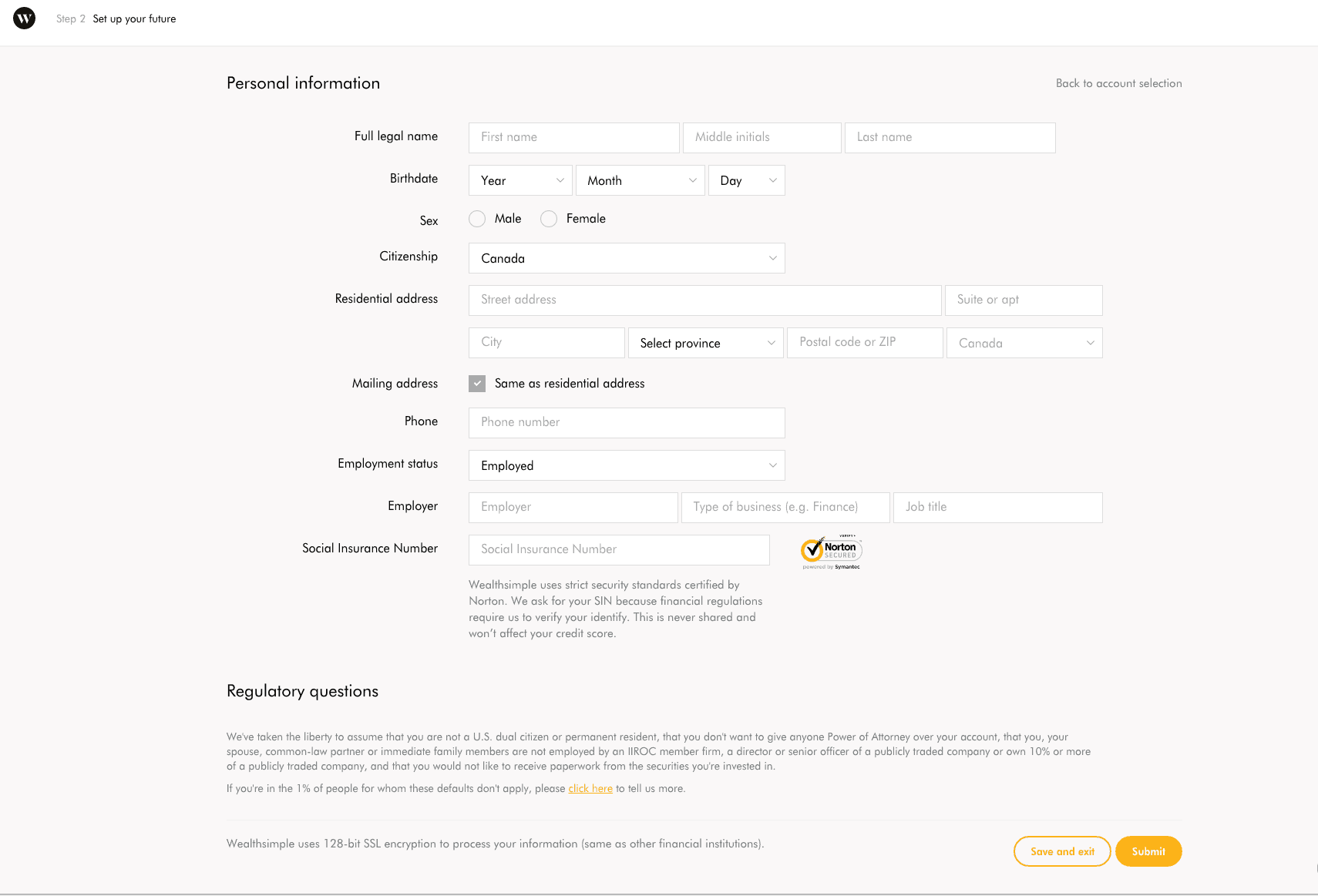

Next you will need to enter your personal information. Nice and simple. U.S. version

Next you will need to enter your personal information. Nice and simple. Canadian version

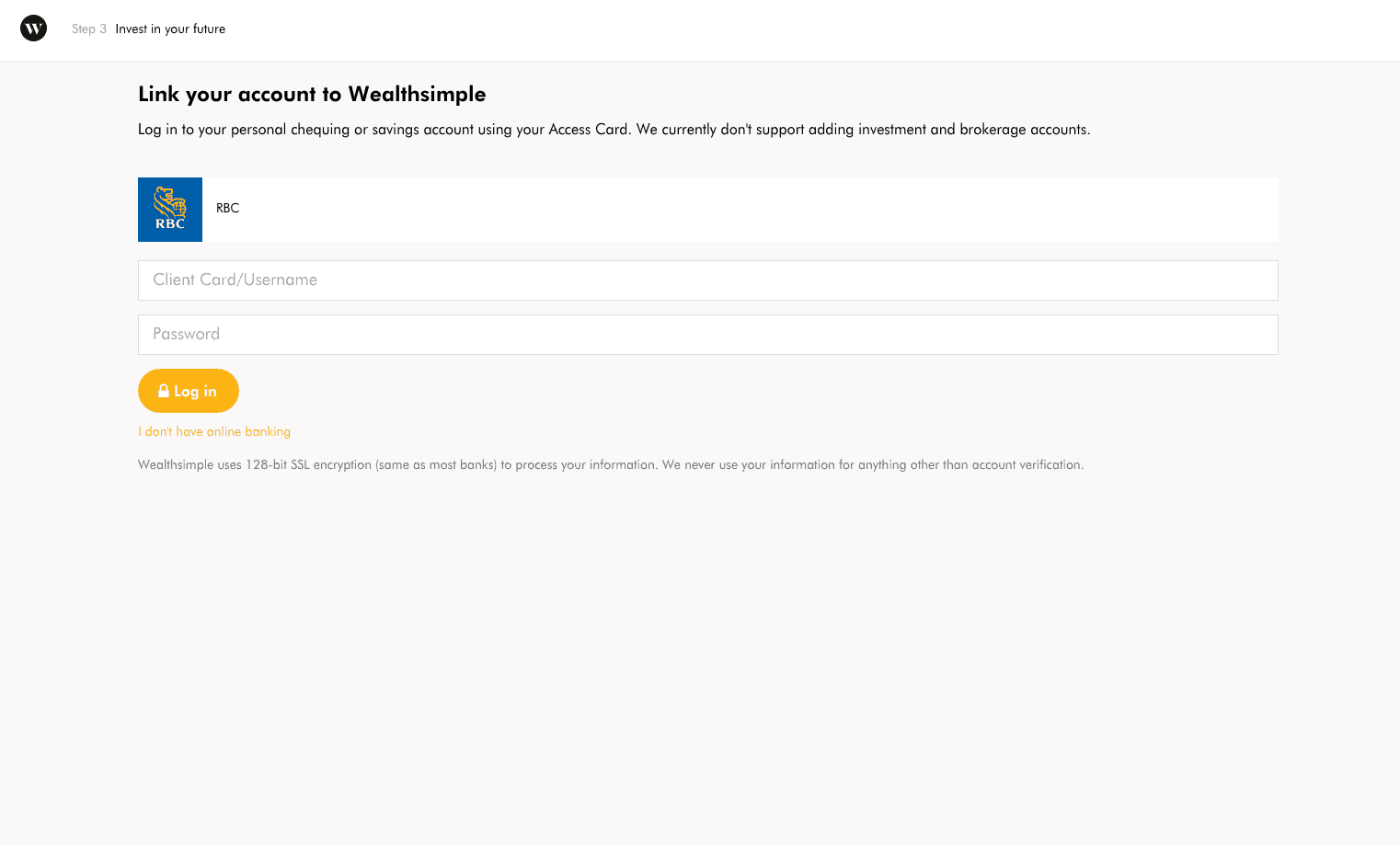

After that you move onto Step 3. See how easy this is. This is where we set up our banking information

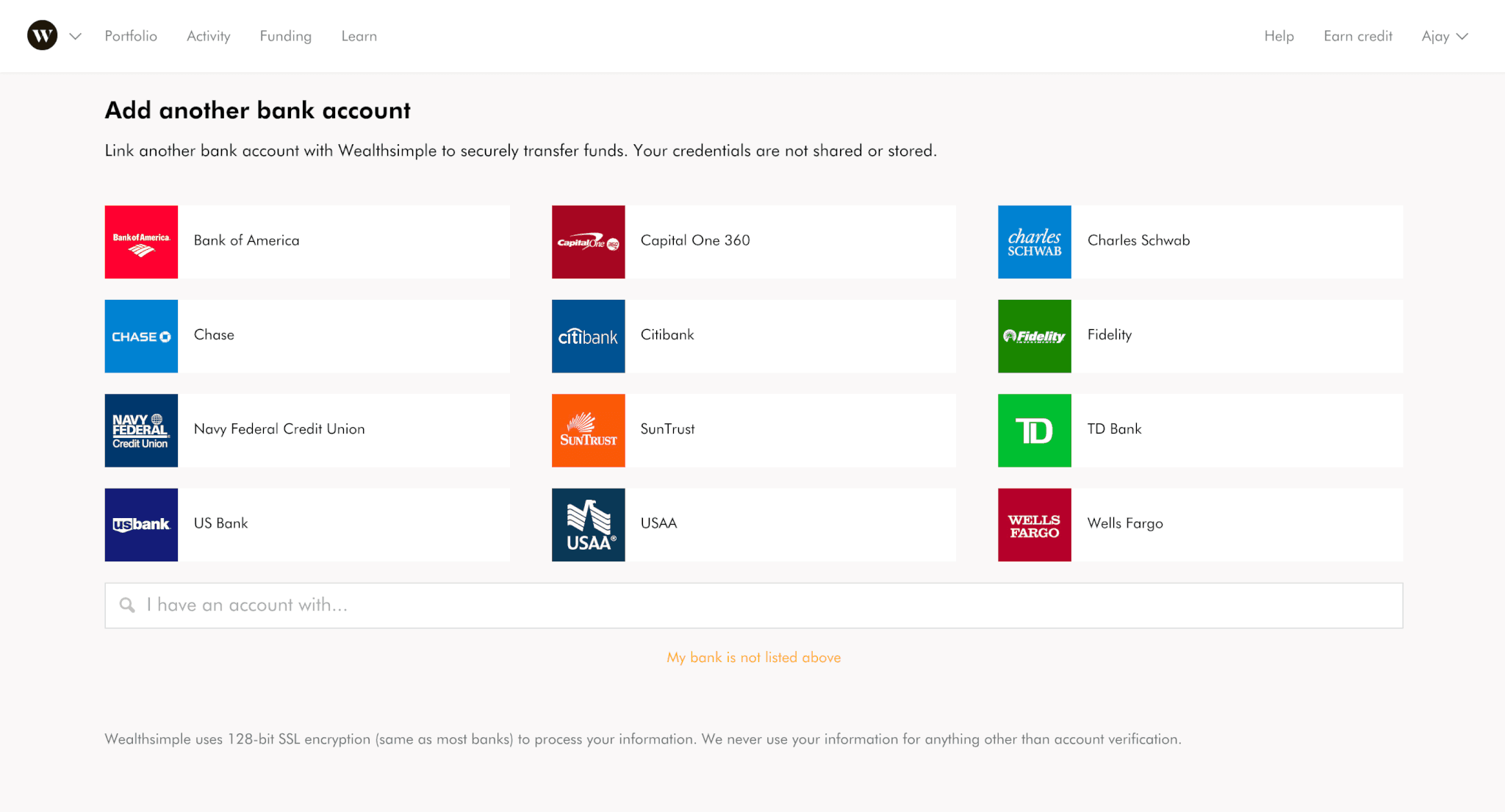

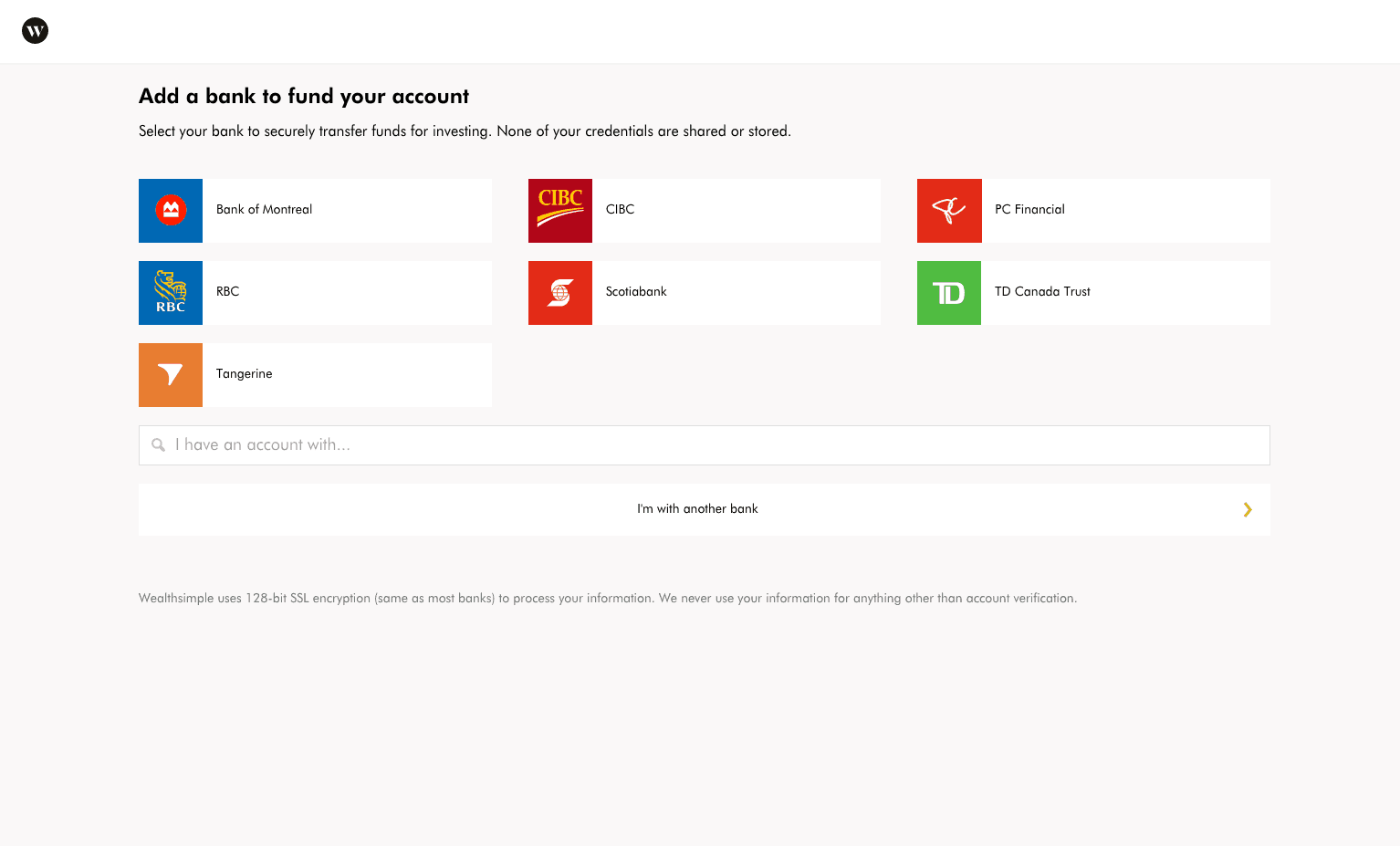

After that you can set up your bank for online transfers directly to Wealthsimple. All within the app. This is great!

These are the US banks and Canadian banks.

Seriously, if you have ever had to drive downtown and pay for parking to meet your investment advisor to sign documents, you know it’s a time suck. This can all be done within the Wealthsimple site. So simple, so easy, so much more free time!

Next you would log into your bank. They are using 128-bit encryption, like all big banks, so you know it’s safe .

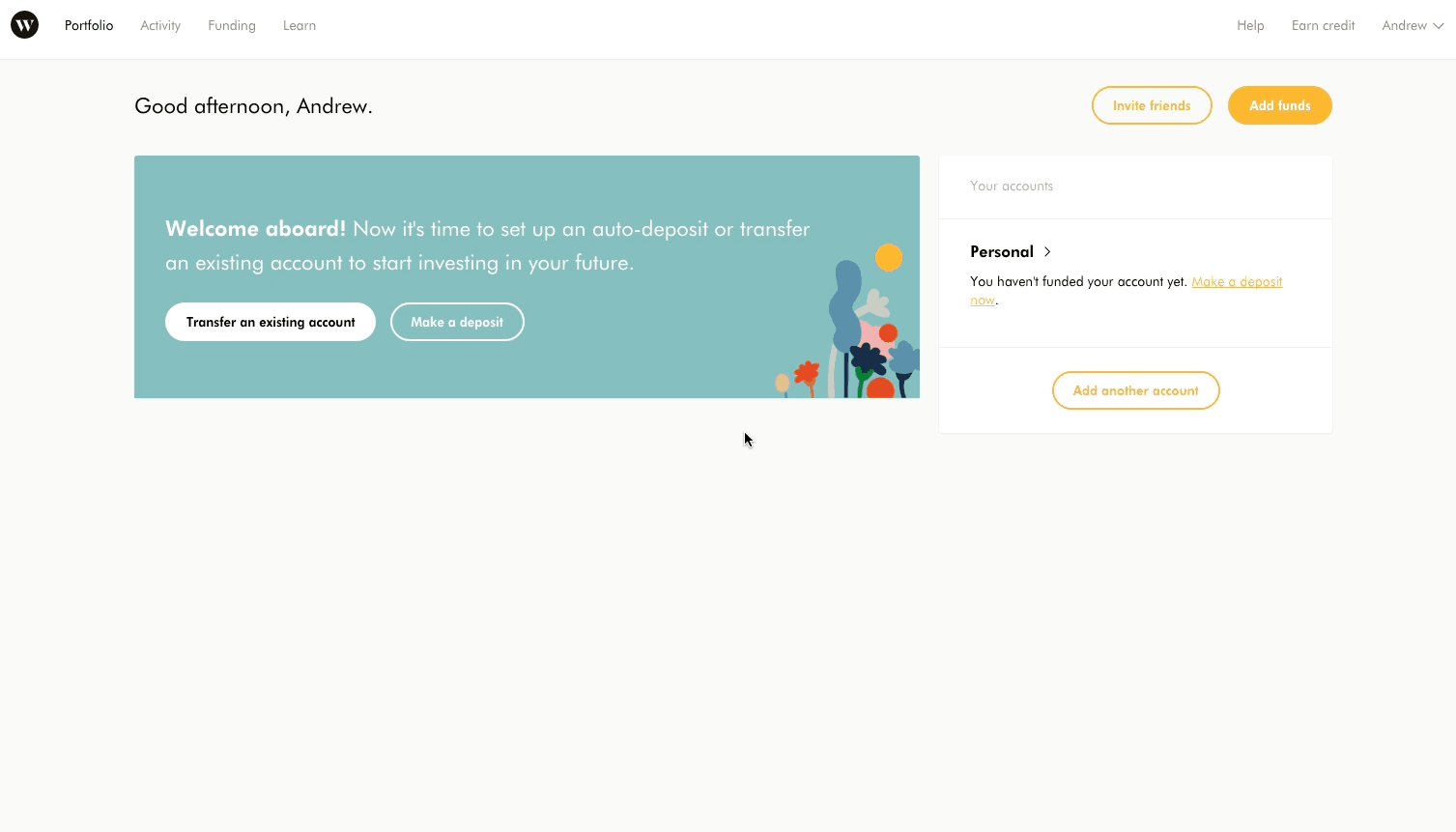

Voila! You are done.

You can sign up for Wealthsimple for free and when you go through our link you will get a sign up bonus of your first $10,000 managed fee free for the first year.

Depending on what your investing needs are and your timeline Wealthsimple could be the right choice for you. Either way check it out. They have some cool stuff on their site to show you how much your investments can grow.

Wealthsimple Sign Up Bonus

Take advantage of this offer today and get your sign up bonus when you open an account.