Welcome to the end of the Money System That Changed My Life!

Let’s Recap!

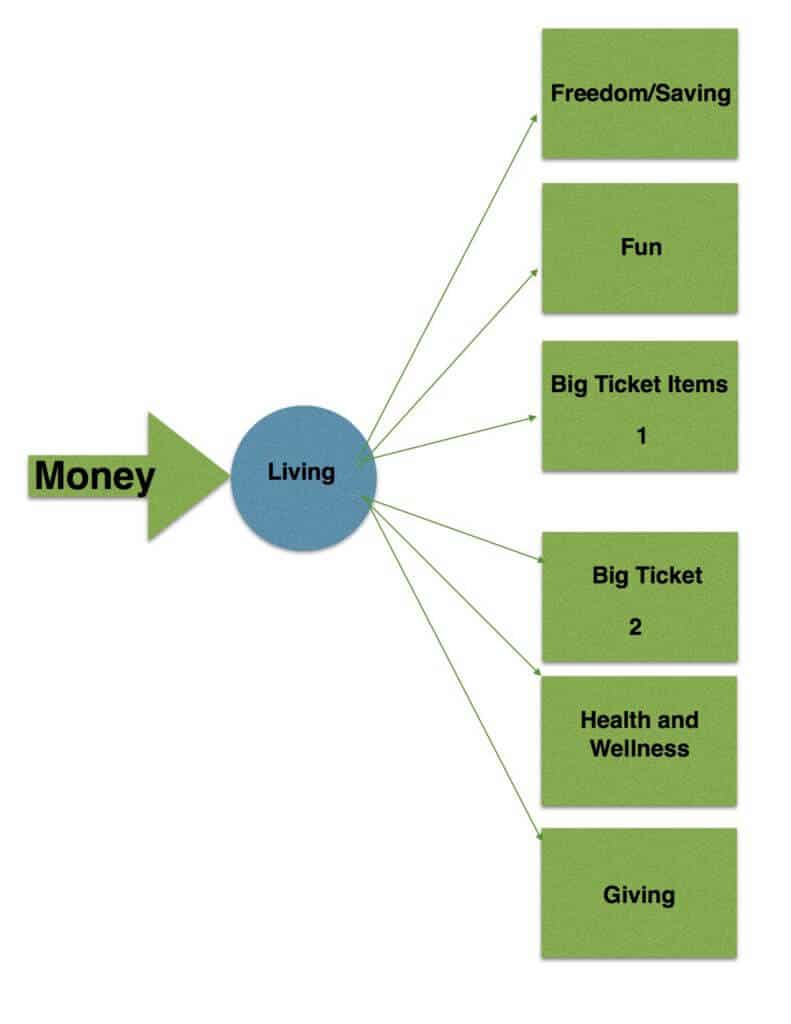

So far we have covered all the accounts

Living

Freedom/Saving

Big Ticket Items

Fun

Education, Health, and Wellness

Giving

If you need to refer back to any of these you can find them here:

Part 1: The Money System That Changed My Life: An Overview

Part 2: Let’s Get F.I.R.E ‘d Up!

Part 3: Let’s Talk About Living

Part 4: Let’s Talk about these Big Ticket Items

Part 5: It’s Time For Some Fun!!!

Part 6: The Rest – Giving, Education, Health, and Wellness

Part 7: Putting it All Together

How Money Flows With The System

The best way I have found to use this system is to have all your money flow into one account (usually Living) then allocate the percentages out from there. So if you get paid $1000 then you break up that amount into the smaller accounts (Fun, Freedom, Big Ticket Items, Giving, Education, Health, and Wellness)

If You Own a Business

If you own a business, budgeting can be a challenge. My best tip would be to get in the habit of paying yourself a regular salary and then put that money into the system.

Automatic = Automagic

The best way to handle your money is automatically. When I adopted this system, I had it set up so that all of our amounts came out of our accounts the day after we got paid. You can do it on the day you get paid, but I have found timing can be an issue (ad you don’t want to have an overdraft charge), so I do it a day after.

The more you can automate the better off your system will be.

Otherwise, you will be trying to remember how much goes where and trying to get around to doing it.

When you automate everything there is no thinking, no remembering, it just happens.

Monitoring Your Spending

There is no shortage of ways to track your spending. The one I hear about most is Personal Capital. With Personal Capital you are able to add all of your bank accounts, mortgages, investments, loans and credit cards. This will give you a great overall money tracker and expense overview. It’s also a great way to see how your money is growing over time.

How Do I Know if the System is Working?

The easiest way to know is if you are improving is that you will be managing to stick within the percentages and watching your accounts grow. But it doesn’t happen overnight.

I had one student that email me 5 years after she took a live class with me. It was stunning how their lives had been changed around. They had a rental property and nearly $50,000 saved up in their F.I.R.E. account and were looking to take things to the next level.

It happens a little bit at a time. Day by day and then eventually you look around and are amazed at how different your money situation is.

Using Credit Cards

A lot of people use credit cards these days, including me. It’s a good idea to have one for emergencies only if you are responsible enough to handle one.

If you are the type of person that always carries a balance on their credit card and can’t help but spend, then do not use a credit card.

The only way I would view it as acceptable to keep a card would be to have one with a low limit for emergencies only. If you don’t think you can handle it, then don’t do it.

This will be hard, but you’ve been paying for your present with your future, now it’s time to get caught up.

If you are out of control with your money do not get a credit card. They can get you into more trouble and that is what you are trying to avoid in creating your system.

If you are using one, this is the way I handle it. Once a month when I get our statement, I go through it and mark things off like this:

Telephone $135 – Living

Restaurant $25 – Fun

Hotel $250 – Big Ticket Item (weekend trip getaway)

Once I have marked all of the amounts I add up the different accounts (Living, Fun, Big Ticket Items etc…) and pay them out of the individual accounts. This is a great way to keep track of your spending if you are on top of your finances.

For smaller accounts like Fun I use a mini- whiteboard through the month to track our spending to make sure we don’t go over.

This may or may not work for you so be aware of what will be the best for your situation.

How To Know If This Is Working?

When we started getting a handle on our money, we also started tracking our Net Worth every month. This was how we were able to see the changes in our accounts.

I strongly recommend that you start tracking your net worth. If you want to learn about tracking your net worth I recommend you sign up for our free email Net Worth Course and

Homework

Make sure to come up with a system for tracking your spending. Personal Capital tracks your spending for you so you can easily keep up to date with your spending.

Automate your system! Set up your accounts to automagically transfer money from one account to the others when you get paid.

That’s it!

That is the whole system. If you have any questions please let me know. I will be checking in with some different ideas to help you along your way. If you are wanting to learn more about investing I would recommend you sign up for our next mini-course “How To Buy Your First Stock”

I would like to both thank and congratulate you for taking your time with this course. If you have any suggestions I would love to hear them. Just click on reply and let me know.

Thank you!

Andrew Daniels