Last time I wrote about how most personal financial freedom formulas weren’t working for me. I ended up explaining my own system to give myself 12 mini goals rather than this one huge goal. After looking at this I took it one step further.

I broke the months down into a grid where I can track my various sources of passive income and watch them grow. It’s my own version of a Financial Freedom tracker, think of it like a Financial Freedom Report Card.

Introducing “The Grid”

The Grid is my Financial Freedom report card. This is where I keep track of all of my predictable passive income. For right now this is just dividends. Later on it will grow and include business income, interest and other passive sources.

I’m breaking out everything into a monthly basis. So for instance, if I need $4,000 in income every month I can see where I’m at on “The Grid”. This is great, I’m a very visual person so it totally helps me see what’s going on with Operation Financial Freedom.

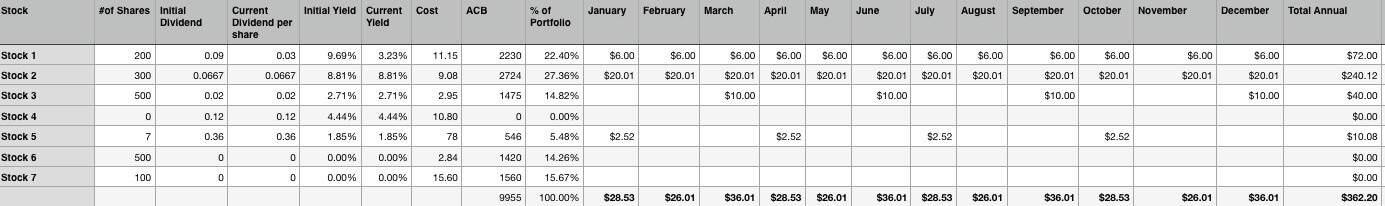

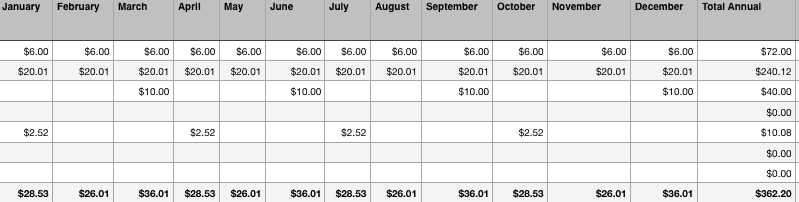

Here is a partial snapshot of The Grid.

Over time, I will keep adding to this. The first stock that I first bought I purchased 200 shares. At first, the dividend was $0.09 (Sweet!) every month so under the Initial Dividend and Current Dividend column I added $0.09. Then entered in a formula to link to the various months it was getting paid out.

Then the dividend dropped and is now yielding $0.03 a month (NOT sweet, bitter in fact, but hey that’s investing) so I made the change in the Current Dividend column and keep track of it. All of the other dividends have been growing or stable when I update the amount the formulas in the spreadsheet automatically update too.

That won’t always be, as nice as it would be for dividends to always grow, I’m living in reality here. Things will always change, that’s why it’s a good idea to pick companies with steadily growing dividends.

Right now I’m working on moving this all over to Google Sheets so that it all updates automatically.

Details of the Payout part of The Grid

The next thing I do is enter in when the money is paid out under the appropriate month column. Dividends are often declared (meaning you need to own the stock on that date) and then paid out a few weeks later.

The payout is the most important part because I want the months to all be above a certain amount so that I can have the security I need to hit my freedom number of $4000 a month.

As you can see some months are bigger than others. This goes back to the timing. If I am going to be getting $5,000 in January and $3,000 in February I need to know so I can plan accordingly.

As you can see I’m a long way from my goal. As we finish up our 5 year family money plan we are getting closer to creating plan for the next 5 to 10 years.

Why No Stock Names?

For the time being I’m going to be leaving out the names of the stocks that I buy. There is a good reason for this. When I was starting out buying stocks, I had no clue what to do. This in turn meant that what everyone else was doing seemed like a good idea, because at the time I had no ideas of my own.

A lot has changed since those first days.

Taking action is a big part, but you have to be willing to learn from that action and the setbacks that come up.

It’s in the losing of tens of thousands of dollars that I have learned what kind of investor and trader I am. What makes sense to me and what I should do moving forward.

It’s a steep price to have paid but I can look back and say it was worth it.

Get Updates Of The Grid

If you are wanting to get updates on “The Grid” and updates on my passive and online income reports you will need to sign up for the newsletter. I’m not comfortable putting this information online yet.

I’ll make it worth your while.

By signing up for the newsletter you will get extra goodies not on the site too!

Simply enter your email in the box below.

I like the concept of the The Grid, Andy. It should be interesting for you to look back on the data in 5 years and 10 years from now.

This is really interesting to me and is along the lines of what I’ve been plotting for my own long-term financial wellbeing. The first step is to pay off the debt. Next step is to get going with investments.

One of the things that worried me is that the withdrawal fees from investment accounts seem to be quite high here in Canada. I’d be charged a minimum of $50 just to get my dividends out and into an account where I could use for living. Is that the same in the US? I could have this all wrong, of course. The investment world, apart from my RRSP’s through work is a bit of a mystery to me at this point.

Hi Jackie, there are a few places you can pull your money out with little or no fees in Canada, that’s a big part of our plan, no fees. For example, Questrade offers no fees for withdrawals up to $25,000 when you do an EFT. You can check them out here FamilyMoneyPlan.com/questrade

Wealthsimple is another one that doesn’t charge fees but you invest in ETFs instead. If you have any questions please ask!