Managing your money can feel like an overwhelming task. In fact, if there is one thing that should have been taught in school it’s how to manage money. But alas (yeah, I used ‘alas’) that course didn’t exist and we are forced to learn about money on our own. Through trial and error, hoping that the mistakes we make aren’t too bad and don’t damage us. Luckily for you, I’ve gone through the good, the bad and the ugly when it comes to money. What’s even better for you is that I’m going to lay out the full way we managed our money. This money budget is super easy to use and you can get started right away so you will finally know how to manage money the right way.

How well does this work? This budget is how we paid off our mortgage fast and how we manage our money in our marriage which has kept us from fighting about money for 15 glorious years.

(Before we begin, this is normally offered as a 7 day course, if you want this delivered in more bite sized chunks to your inbox, just enter your email below)

Table of Contents

Part 1: Let’s Clear the Air With An Overview

If you have tried other budgets in the past I hope that this one can offer you a new view on how to manage your money and help you the way this system helped me. Even if you only take one or two parts of this system and use it for yourself you are making progress and that’s wonderful!

The First Key Ingredient That Was Missing From My Finances Was A Simple One

PURPOSE

Think about it. When you have a purpose you have focus.

Purpose gives you direction.

Purpose is the difference between going through life aimlessly and going for what you want.

Tell me if this sounds all too familiar…

You decide you want to get good with money so you start saving and cutting back, only to have it blow up a few months later because something shiny caught your eye.

Or worse, you are getting better with your daily living expenses and then you have it implode on you right when you seem to be getting the hang of it.

I was a bit of a yo-yo saver before this system. Too many times, I would save, but I wouldn’t know exactly why I was saving.

Then there were times when I would save up a bunch of money only to blow it on something I wanted in the moment (A.K.A. Shiny Object Syndrome). This would make me feel good for a day or two. Then I would feel terrible and then start the saving cycle over again. One step forward, two steps back.

But once I had a purpose, everything changed.

The Other Ingredient That Was Missing From Every Other Budget I Tried Was:

BALANCE

Every budget I tried before felt like I was restricting myself too much. I don’t want to feel like I can’t do anything for years at a time. Sometimes, I just want to go to a movie and get the overpriced popcorn and drink!

Once I found some balance in my budget and combined it with purpose everything changed.

Your life is broken out into different parts, and your finances should be too.

Think about your life, it’s made up of the following:

-

-

- Things you have to do now.

- Things you want to do now.

- Things you need to do later.

- Things you want to do later.

-

Plus being able to enjoy those things when you get to do them.

Think about your money it’s the same way:

You have your living expenses (Things you have to do now)

You have your fun and entertainment. (Things you want to do now)

You have the things you are going to do in the future. (Things you need to do later)

You have the fun things you are going to do in the future. (Things you want to do later)

Plus you have the things that you need to do on an ongoing basis to ensure you can enjoy your future. (Stay healthy and sharp)

The Founding Principle Of The System

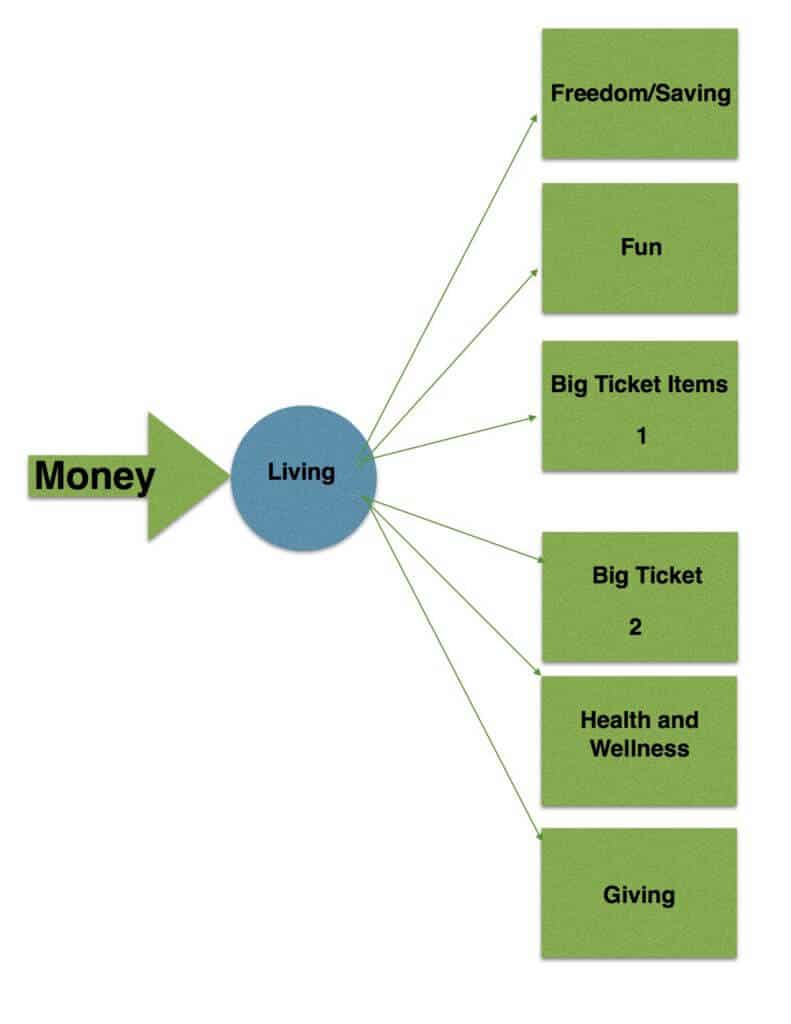

Here is the founding principle: Split your money up into groups. Keep it separate. Give each of those accounts a purpose.

I’ll repeat that because it’s so important:

Split your money up into different accounts. Keep it separate. Give each of those accounts a purpose.

There are 6 main accounts in the system:

-

-

- Living

- F.I.R.E./Saving for Retirement

- Big Ticket Items

- Fun

- Education, Health, and Wellness

- Giving

-

How the Accounts Breakdown

We will dive deeper into each of these, but here is a quick overview of what each account is made up of.

Living – Things you need to do now – 50%

Now, this doesn’t mean save half, it means living on half.

This money is meant for food, gas, clothes, shelter, utilities. All of your daily living comes out of this one account.

(Psst… Don’t let this scare you, the first time I looked at it I felt the same way.)

F.I.R.E (A.K.A. Savings) – 10%- 20%

If you are new to the term F.I.R.E (Financial Independence and Retire Early) the concept is to have enough money coming in from your investments to cover your costs of living. This was you can be financially free.

The F.I.R.E account is for building your nest egg, retirement fund, streams of passive income. Whatever will help you fund your life so you can enjoy retirement.

The typical personal finance book will tell you to save 10%, my thoughts are you should aim for 20% if you can. Like all of the percentages here it’s adjustable.

The only rule is to never decrease it from where you start. So if you are starting at 10% and you increase it to 11% then you never decrease it.

Big Ticket Items 5%-20%

This account is for big items. Think of it as short-term savings account for things you will want or need later on.

Things like:

- Car

- Trips

- New Furniture

- Home Renovations

- Down Payment on a House

- Christmas and Birthday Gifts

Anything that is going to take a few months of saving goes in here.

A quick guideline: A Big Ticket Item is if you need to save up for more than 3 months. This can also be where you save for an emergency fund too.

Play/Fun – Things you want to do now – 10%

This was missing out in all of the other budgets we tried. I have to say it’s a game changer.

Saving a lot of money made sense but I often did it at the expense of play. Which would work for a while then and then I would go on a spending spree (on whatever I had my eyes on at the time, honestly looking back 10 years I’m hard pressed to remember… a Nintendo Wii… wait was that 10 years ago?!? Geez…)

Education, Health, and Wellness 5%-10%

What is the point of saving your money, and living a good life within your means, if you aren’t around to enjoy it?

If you ask me the purpose of life is to grow… well that and to keep on living. 😉

The amount in this account is reserved for gym memberships, coaching, books, learning new skills and other things that will keep your body and mind active and in good standing. A great place to put the money is in your Health Savings Account (HSA) if you are in the States. Here’s some details on HSA’s and how they work.

Giving – Entirely Up To You

There are a lot of rules about giving. Some say 10%, others say more, some say none.

What you chose to give is up to you.

That’s right you go ahead and make your own rules.

I have done free classes and donate to charity. I like to give some money and some time. Honestly giving my time is more valuable to me than money in a lot of ways.

There you have it, 6 main accounts and a few smaller ones.

About Those Percentages…

The first time I saw these percentages I thought, “Nope not going to happen, I don’t look at my money this way”

Then I realized that it didn’t matter.

My money was already being handled using percentages. I just wasn’t paying attention to them in that way.

The most common question is; “Can I change the percentages?”

The answer is: ABSOLUTELY!

You need to figure out how to make this system work. These percentages are used as guidelines. If you need to change around the percentage then go ahead. The only one that stays fixed is saving at least 10%.

Part 1 Action Step

I only need you to do one thing for this part. Find out if your bank is charging you for the privilege of banking with them. If not call them and ask for no fee banking.

I changed to no fee banking and I haven’t paid a monthly banking fee in 15 years. I have multiple accounts with our system, and from that 1 change of banks, I estimate that I save between $25 and $50 a month in banking fees.

If you are in Canada there is Simplii Financial if you are in the U.S. here are a few banks that could help. I haven’t checked these out so you will need to do your own research.

Alliant Credit Union, Elements Financial, USAA, Navy Federal Credit Union please make sure to check if they offer free banking. I have not looked into these banks so please do your due diligence.

Or if you want to keep your bank and just have your savings accounts somewhere else, we use Wealthsimples Smart Saving Accounts. They are easy to get started and don’t have any fees, plus as a reader of this you get a $50 bonus when you deposit $100 in your first month. Double win!

You can learn more about Wealthsimple and get your bonus here.

A Few Notes When Starting to Manage Your Money

Give yourself time

A lot of times people jump into a new way to manage money and it doesn’t work in the first month, or the second, or the third… It’s NORMAL! Nothing is easy if you have never done it before.

You will be making small improvements all the time, then in a few months, you will look back and be amazed at the small changes that added up.

Don’t Do This…

Whenever the idea of using multiple accounts come up it can sound scary and overwhelming.

It’s not. What’s scary and overwhelming is not having control of your money.

A lot of people say: “I’m just going to keep track in my head.”

Which is great if you have the time. But I have tried both ways and doing the physical tracking versus the mental system and the physical one (a.k.a. multiple bank accounts) works way better.

While we are on the topic of bank accounts

There are a lot of banks that do not charge you for the privilege of holding your money. Think about this for a second. If you went to a person and said “Can you hold on to this $1000 for me”, would you expect that person to reply, “Sure for $10 a month I can hold on to that money for you”

HUH?!

Paying bank fees makes no sense. For the love of the almighty please make a commitment to switching banks today. Or at the very least demand from your bank to not pay fees. It’s absurd.

Part 2: Let’s Talk About F.I.R.E.

Imagine this: It’s a few years from now, you drive into work, this is your last day.

Some time ago you decided to take control of your money. Since then you have been handling your money properly. You haven’t stressed about money in years because you found a way to manage money that works for you.

Because of this new found control, you are able to retire without worry. You have finally found your FREEDOM!

Let’s Talk About F.I.R.E. – Financially Independent Retire Early

In the personal finance community the word is F.I.R.E (Financially Independent, Retire Early) and it gets thrown around a lot.

What it means is having enough income from your investments so that you are able to leave your job and do what you truly love to do (assuming you aren’t doing that already).

This account is all about the ability to quit your job once you have enough money saved up.

This should be your ultimate long-term goal. To achieve financial independence so that you can retire early.

The Biggest Mistake People Make With Their Budget

Whenever someone tries to budget, they start trying to figure out their spending and their costs and start cutting expenses. Costs are important, but it’s better to take a long-term focus and put first things first. With the focus on cost cutting the give very little attention to how much they save.

Most commonly I hear: “I’ll save whatever is left at the end of the month.”

I’ve been guilty of this too A lot. Like a lot, a lot.

It sounds great, but if you were like me, there was never anything left at the end of the month.

*GULP*

Put another way, there was often more month at the end of the money.

*DOUBLE GULP*

Your future freedom is all about getting yourself set up for the long-term. Which is why you need to make saving your first priority.

From now on, “Pay Yourself First” should be your mantra.

How Much Should I Save for Retirement?

Go through many of the personal finance books and you will read that you should always save 10% of what you make. When I started working in the “real world” I preferred 10%. I felt good that I was putting some money away every paycheck.

Then when I got into personal finance I did some math and found a scary truth:

Saving 10% is not enough in many cases

A Different Way To Look At Saving for Retirement

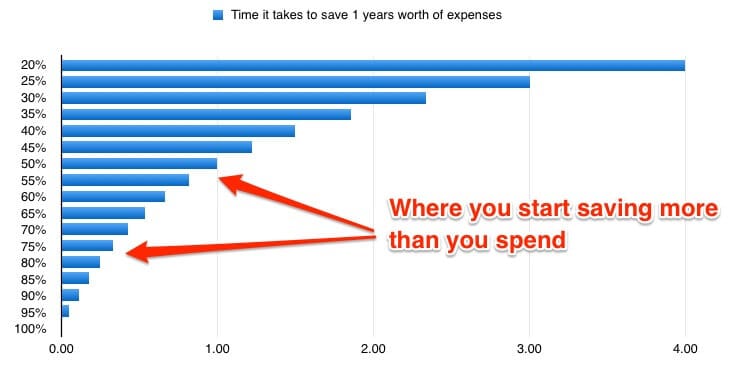

With F.I.R.E in mind consider this: If you save 10% then it takes 9 years to save up 1 years worth of expenses.

Or to look at it another way, if you save 10% for 9 years, you can live the 10th year for free.

That sucks… I mean it’s better than nothing, but still…

Here’s why; saving 10% means out of 40 working years you will have saved 4.5 years or so of Freedom (not including investment returns, inflation and a bunch of other things).

It’s just not enough.

When you look at how much you should save everyone has a different idea.

Here’s How Another Way of Looking At It

I like to think of things like this: If you make $10,000 a year and save 20%, then you live off $8000. Which means you save $2000 a year.

After 4 years, you have saved up enough for 1 year of expenses.

The more you increase that savings amount the quicker you save.

Here is what it takes to save up for 1 year of expenses:

How many years to save 1 years worth of expenses

The F.I.R.E. Account

This account is where you pay yourself first. You will be putting a percentage of your pay into it every time you get paid.

EVERY. TIME. YOU. GET. PAID.

What Do I Use This Money For?

This money is used to fund your F.I.R.E. (i.e. Freedom/Retirement/Walk Away From Work). You are growing this account so that you can use the money to fund your retirement.

What to do with the F.I.R.E. Account

This account is for growing your nest egg. You want to grow this nest egg so big that you can live off the residual income it provides.

How Do I Do This?

The simplest explanation to grow your money is to invest. Investing is outside the scope of this course but I’ll give you a quick overview of the two types on investments I usually consider.

Asset Growth

Investing in assets that will grow in value. (Like Stocks, Businesses, Bonds, Land, Real Estate etc…) Anything that can increase in value over time so eventually you can sell it for more money than you paid for it.

Passive Income

Passive income is when you own something that pays you a residual for owning it. If you are new to the idea of passive income and want to learn more about what passive income is you can read this article.

Some passive income ideas are:

- Passive income from stocks through dividends

- Royalties from books, songs and other intellectual property

- Rental Income from Real Estate

Investing In It’s Purest Form

Don’t be intimidate by investing. In the simplest terms: Investing is anything that you can do to get a return on your money greater than what you put in.

You Might Be Investing and Not Know It

Before you get worried about investing I will tell you a way I used to “Invest” without knowing it.

When I was younger, I had a job at a used music store. Part of this work had people coming in to find a good deal on a used guitar.

To fill this need I would go out to people’s houses and pawn shops and look for musical instruments that I could resell. It was very common to find a guitar for $100 that I could easily sell for $200 or more within a few months, sometimes the same week.

Now this wasn’t “sophisticated” investing. But I was getting an amazing return on my money in a very short time.

The point of this story?

There are tons of ways to grow your money, don’t be intimated by stocks or real estate. More importantly don’t feel like you need to invest in them if you don’t understand.

As a rule, it’s a good idea to never invest in something you don’t understand.

I have heard of people that go to thrift shops and buy vintage clothing then turn around and sell it on Ebay for 30 times what they paid for it.

The trick here is that you probably have knowledge of something you can leverage into some type of investment and get a return on your money.

Think outside the box.

If you already have more conventional investments and are looking for a way to look at all of them in one snapshot you should check out Personal Capital. With Personal Capital you are able to add all of your bank accounts, mortgages, investments, loans and credit cards. This will give you a great overall money tracker and expense overview. It’s also a great way to see how you money is growing over time.

Action Step For Your F.I.R.E. Account

Decide how much of your take-home income you want to save. Then decided how much you are going to start saving.

If you are starting at 10% trying raising it 1% a month until you get to your ideal number it may be easier than you realize.

Part 3: Let’s Talk About Living

This account is a big one. Daily life. I simply call this my Living expenses, because… well it’s for living! If you want you can call it Needs, or Daily Life.

Give it a name that represents what this money is actually for which is:

Living Your Life

This is where most of your money will go to.

How Much Should I Put Into My Living Account?

As a rule, I aim to have 50% of my income in Living Expenses. Remember this is a goal, not a starting point. As we make our way through the system you will find that when you move certain amounts of what you consider to be normal living (like dining out, movies and entertainment) out to other accounts that this 50% gets closer to reality.

What Makes up the Living account?

A great way to know if an item belongs in the living account is to ask yourself the question, “Do I need this to live?”

Notice I didn’t say “Do I want this to live”.

We need food to live. We don’t need popcorn every time we go to the movie theatre (there’s another account for that, don’t worry).

Among the items that can go into your living expenses:

- Food

- Gas

- Clothing

- Mortgage or Rent

- Property Taxes

- Insurances (Car, Home, Life, Disability, Critical Illness)

- Car Payments

- Cell Phones

- Home Phones

- Internet

- Heating

- Electricity

- Make-up and Hair

- Pets

- Children’s stuff (I’m calling it stuff because there are so many things that can go in this)

- Hair and Grooming

- Magazines

- Television

- Water

- Alimony

- Daycare

- Allowances

- Medicines

- And any other expenses that cost your life

Seems like a lot of stuff to fit into 50% of your income, doesn’t it?

That’s what I thought too! But I worked at it.

Bit by bit it came down.

Before you can start getting your expenses under control you need to know what your expenses are.

Here is a spreadsheet to help you track your monthly expenses. I find it best to figure out the recurring monthly expenses (i.e. fixed expenses) that way I know how much I have to work with. Then move on to the non-fixed costs like food and transportation.

You Improve What You Track

There are numerous studies that show what you track you improve upon. It’s no wonder everyone is wearing a fitness tracker these days. Your spending is no different. By keeping track of your spending and making a budget you will be able to have a better handle on your finances.

Start Tracking Your Spending Today

If you aren’t already tracking your expenses and spending, you need to start today. You can either go back through your old bank and credit card statements (if you are a finance geek then you are drooling over this idea) and enter them into a spreadsheet. Or decide that going forward you will be tracking your expenses.

Personally I love Tiller, they put all of your spending into a Google Sheet for less than $5 a month. I absolutely love, it you can read our Tiller review and see more about it.

Or you can give them a try here.

A Better Way To Track Your Spending

If you are going to start tracking digitally most blogger swear by Personal Capital. It allows you to combine all of your accounts and credit cards, so you can see a total overview of your finances. Best of all it’s Free!

If you are outside of the U.S. your options are a little more limited, the other one is Mint and Tiller like I mentioned earlier

Start tracking your expenses and see where your money is going.

Part 3 Action Step: Get Tracking

Come up with a list of all your monthly fixed expenses and enter them into the spreadsheet. If you aren’t familiar with spreadsheets I made a quick video to go along with it here.

If you aren’t tracking your expenses yet you can use a spreadsheet or a free service like Personal Capital. Not only do they track your spending, but also your net worth.

And if you want to take it to the next level and save yourself some time, you can track things with Tiller.

Part 4: Let’s Talk about these Big Ticket Items

So far we have covered saving for F.I.R.E. (10%-20%) and our Daily Living Expenses (50%).

But what about those things that aren’t day-to-day? Those items that fall into the “Need to do later” category?

Well, I’m glad you asked. Because now we are going to look into Big Ticket Items.

What’s a Big Ticket Item?

Big Ticket Items are things that you spend money on that take some time to save up.

Things like:

Car

Trips

Repairs

Electronics

New Furniture

Home Renovations

Down payment on a house

Christmas and Birthday Gifts

Here’s The Rule for a Big Ticket Item

If you need to save more than 3 months for it, it’s a Big Ticket Item. Pure and Simple.

Want to go somewhere nice for a weekend?

Have an account for that.

Need to stash away some money for Disney with the family?

Start a different account for that.

Car starting to show it’s age?

Start a separate account for that.

You get the idea. Every big item that you are going to need at some later date you can create it’s own account. It’s so much easier when you can see these accounts grow.

How Much Should You Put Towards These Accounts?

That is entirely up to you. Isn’t this system great?

I aim for at least 10%, through all of the sub accounts, but it depends on what we are saving up for and how fast we want to save for it.

Personally, we have 3-5 BTI (Big Ticket Item) accounts on the go at any given time. Right now they are:

Big Trip: 2%

Repairs (a.k.a. In Case It Breaks) : 2%

Summer Vacation: 5%

Christmas and Yearly Gifts: 4%

As you can see we are doing more than 10% of our income, but that is the joy of this system. It’s adjustable to you.

Do I need to Have a Separate Account For Each Big Ticket Item?

YES! I strongly recommend that you split up the Big Ticket Items into different accounts. That way you can see them all grow.

It’s also why you want to be with a bank that doesn’t charge monthly fees. This is a great way to keep your amounts separate and watch them grow. That way you don’t end up spending the money for Grandma’s Christmas gift on your trip to Hawaii. 🙂

Remember: You can change the amounts around as you need to. It’s entirely up to you.

A Quick Warning

While you may want to have just 1 account and do the math in your head about how much you have saved for each item. I would strongly recommend against it.

This is usually a recipe for disaster.

In my experience, as you look at the 1 big amount you will use it for whatever is most urgent and that ends up wiping out the other accounts. Keeping them all separate is the best way to go.

Part 4 Action Step: Create an Account

Tonight’s homework is a simple two step process.

First, decide on how many Big Ticket Items you want to be saving up for.

Second, decide how much each month you want to be putting towards these accounts.

Don’t forget your emergency fund!

IF you are looking for a place to put your money, we use the Wealthsimple Smart Savings Account. It’s easy to use and get started with, best of all they offer a $50 bonus, to readers of Family Money Plan (that’s you), when you deposit $100 into your account in the first 30 days. You can check Wealthsimple out here.

Part 5: It’s Time For Some Fun!!!

As I’ve said, there is nothing really hard about this system. It’s just a different way of looking at your money.

I’ll start off by saying, this account is why our system has worked for us for 10 years. It’s been a key to sticking to this system.

Like I mentioned earlier, I believe this is the most important part of the system.

I believe that without our Fun Account, there would have been a severe fallout somewhere around month 8 ( or likely sooner than that).

Here is why the Fun Account is SOOOOOO Important!

A) It’s for fun!

B) It rewards you for doing good in all your other areas of the money system.

C) It gives you balance in your life.

What is the Fun Account for?

The Fun Account is all about fun! Use this account for things you enjoy like: Movies, Sporting Events, Concerts, Date Nights, Restaurants it all goes in there.

If you want to spend the whole months amount on a fancy dinner.

Do it!

Want to split it up over the weeks so you can do something equally fun every weekend?

Do it!

I like to think of it as my weekend money. During the week everything is pretty much “Even-Steven” where the routine prevails and you are just getting through the week.

But the weekend… when you have more time to do the fun stuff, that my friend is where the Fun Account kicks in!

Of course, you probably have a waayyy cooler life than me and do things during the week. If so go for it! Then let me know what it’s like to go out on a Wednesday. 😉

How Much Goes into the Fun Account? 10%

As a starting guideline, I say 10% of your income. I wouldn’t do more than 10%. The key here is to make sure you have some money every month to enjoy life.

The goal here is to enjoy taking control of your money, not feeling like you are trapped by your money system.

One Rule for the Fun Account

There is one rule I have for the Fun Account. You have to spend it by the end of the following month. Any longer than that it’s a Big Ticket Item and there should be a separate account for that.

Part 4 Action Step

There’s 2 things you need to do for this section.

First, decide on what items are Fun Account worthy. Are there any you would like to drop or add?

Second, decide how much of your income you want to put towards Fun activities.

And of course, Have Fun!

Part 6: The Rest – Giving, Education, Health, and Wellness

The rest is about being able to enjoy life and give back.

More importantly, it’s about lasting so that you are healthy enough to enjoy a nice long life.

All this talk about money is great. We are getting a handle on our finances and changing things around for the better. It’s going to take a little time, but you knew that. 🙂

How Much Goes Into the Education, Health, and Wellness Account?

This amount is entirely up for change (much like the rest of the system). The purpose is to make sure you are using some money to keep improving yourself both physically and mentally. I have found the ability to keep active makes all the difference in how I feel. The better I feel, the easier it is to keep on this system.

What makes up the Education, Health, and Wellness Account?

The education, health, and wellness account is made up of anything to better yourself. Whether that is exercise, taking a course, or anything else that is going to help you improve and live a nice long life.

This account is a great way to learn about investing and different ways to build up your F.I.R.E. Account too. Use this money for classes, educate yourself, try something new, play a sport, or a spa day.

The whole point of this account is to do things that revitalize, inspire and matter to you so you can enjoy life as you watch your accounts grow.

Side note: This account we also use as an education account. It’s how I was able to take a course on building a website and start Family Money Plan, which has been a life-changing experience for me.

A Few Words About Giving

There are a lot of rules about giving. Some say 10%, others say more, some say none. What you chose to give is up to you. I give some money to charities that are of importance to us and some time. Honestly giving my time is more valuable to me than money in a lot of ways.

Please, in one way or another, find a way to give. It does as much good for you as it does for the people you give to.

Part 6 Action Step

Decide on your amounts for your Education, Health, and Wellness and think about what goes into this account.

Will it be grown to take courses, or used every month for a gym membership, or an occasional spa day?

It’s up to you!

Part 7: Putting it All Together

Let’s Recap!

So far we have covered all the accounts

- Living

- Freedom/Saving

- Big Ticket Items

- Fun

- Education, Health, and Wellness

- Giving:

How Money Flows With The System

The best way I have found to use this system is to have all your money flow into one account (usually Living) then allocate the percentages out from there. So if you get paid $1000 then you break up that amount into the smaller accounts (Fun, Freedom, Big Ticket Items, Giving, Education, Health, and Wellness)

If You Own a Business

If you own a business, budgeting can be a challenge. My best tip would be to get in the habit of paying yourself a regular salary and then put that money into the system.

Automatic = Automagic

The best way to handle your money is automatically. When I adopted this system, I had it set up so that all of our amounts came out of our accounts the day after we got paid. You can do it on the day you get paid, but I have found timing can be an issue (ad you don’t want to have an overdraft charge), so I do it a day after.

The more you can automate the better off your system will be.

Otherwise, you will be trying to remember how much goes where and trying to get around to doing it.

When you automate everything there is no thinking, no remembering, it just happens.

Monitoring Your Spending

There is no shortage of ways to track your spending. The one I hear about most is Personal Capital. With Personal Capital you are able to add all of your bank accounts, mortgages, investments, loans and credit cards. This will give you a great overall money tracker and expense overview. It’s also a great way to see how your money is growing over time.

If you want to use what I use, it’s called Tiller. You can check it out here.

How Do I Know if the System is Working?

The easiest way to know is if you are improving is that you will be managing to stick within the percentages and watching your accounts grow. But it doesn’t happen overnight.

I had one student that email me 5 years after she took a live class with me. It was stunning how their lives had been changed around. They had a rental property and nearly $50,000 saved up in their F.I.R.E. account and were looking to take things to the next level.

It happens a little bit at a time. Day by day and then eventually you look around and are amazed at how different your money situation is.

Using Credit Cards

A lot of people use credit cards these days, including me. It’s a good idea to have one for emergencies only if you are responsible enough to handle one.

If you are the type of person that always carries a balance on their credit card and can’t help but spend, then do not use a credit card.

The only way I would view it as acceptable to keep a card would be to have one with a low limit for emergencies only.

If you don’t think you can handle it, then don’t do it.

This will be hard, but you’ve been paying for your present with your future, now it’s time to get caught up.

If you are out of control with your money do not get a credit card. They can get you into more trouble and that is what you are trying to avoid in creating your budgeting system.

If you are using one, this is the way I handle it. Once a month when I get our statement, I go through it and mark things off like this:

Telephone $135 – Living

Restaurant $25 – Fun

Hotel $250 – Big Ticket Item (weekend trip getaway)

Once I have marked all of the amounts I add up the different accounts (Living, Fun, Big Ticket Items etc…) and pay them out of the individual bank accounts. This is a great way to keep track of your spending if you are on top of your finances.

For smaller accounts like Fun I use a mini- whiteboard through the month to track our spending to make sure we don’t go over.

This may or may not work for you so be aware of what will be the best for your situation.

How To Know If This Is Working?

When we started getting a handle on our money, we also started tracking our Net Worth every month. This was how we were able to see the changes in our accounts.

I strongly recommend that you start tracking your net worth.This is a great way to see how your money is going from month to month.

Final Step Action Plan

Make sure to come up with a system for tracking your spending. Personal Capital tracks your spending for you so you can easily keep up to date with your spending. We use Tiller for our budgeting purposes, it tracks everything in a Google sheet and is well for the couple of bucks a month they charge. You can check out Tiller here.

Automate your system! Set up your accounts to automagically transfer money from one account to the others when you get paid.

That’s it!

That is the whole system. If you have any questions please let me know. I will be checking in with some different ideas to help you along your way.

I would like to both thank and congratulate you for taking your time with this course. If you have any suggestions I would love to hear them. Just click on reply and let me know.

Share this so others can become awesome with their money as well