Imagine waking up not too long from now and you are completely out of debt. What would you do differently? This has been my reality for the past year. I have to say life without debt is as sweet as I thought it would be. This isn’t going to be your standard 5 steps “how to get out of debt fast” article. You have likely already seen these articles, and if you are like me, they come up short on giving you actionable steps to get out of debt.

Because when you want to get out of debt fast you need more than a quick 5 steps.

I’m going to go into a lot of detail. Doing this means I’ll address some of the bigger issues most of these other articles on how to get out of debt leave out. Because when it comes to paying off debt 10% is mechanics, and 90% is mindset and support.

First; Who Am I, and Am I Qualified to Give Advice on How To Get Out of Debt?

Before you listen to me you should know where I’m coming from. My family paid off $320,000 in mortgage debt, another $40,000 in car loans and $20,000 in hydro loans in 7 years.

I know what’s involved in getting out of debt. I’m not a financial wizard, in fact, I’m the most average person I know.

The difference is that I’m someone who got hooked on the idea of getting out of debt. Then I decided to stay on that path until it the debt was gone.

And if I can do it, you can do it too!

I feel like you and I are kindred spirits. This is what I would have wanted to see when I started to get out of debt.

(This post is long, and you will likely want to refer to it, so you can get a PDF version of this sent to you by entering your email here and subscribing to our weekly newsletter)

Now Let’s Answer the Burning Question: Is There a Little Blue Pill that Pays Off All Your Debt Fast?

Let’s cut to the chase.

If you are here because you want to find a shortcut to get out of debt I have some bad news.

It doesn’t exist. You have a better chance of finding a unicorn.

Do yourself a favor and quit looking for the quick and easy way out and start doing what needs to be done to get out of debt.

I wasted a year looking for a better solution. There isn’t one. If there was everyone would have done it already and we would all be debt free.

Still with me? Good!

Let’s nail this whole get out debt business.

Before You Begin: What Do You Need to Pay Off Your Debt and Become Debt Free Once and For All?

There are a few things you need to get out of debt. Mindset is the biggest factor between someone who pays off their debt fast and someone who gives up along the way. Looking at others that became debt free these are the items that stood out.

1. A “Can-Do” Attitude

It sounds funny but the biggest thing you need is the right attitude. You need to believe you can do it.

With the right attitude, you will keep persevering when the moments of doubt come up.

Getting out of debt takes time and you need to know you can do it.

2. Find Someone Who Believes in You

To help you out with number 1, having someone to believe in you is key. Even though we haven’t met, I believe in you.

By reading this you have a better leg up than I ever did to pay off our debt. I didn’t even know becoming debt free was possible when I started.

I decided one day that being in debt sucked and started to walk my way out of it.

One of the most important things is to have someone you can tell your successes to.

Because everyone else will be in the “See what I bought mode”, you are going down a better path.

You are on the path of owning your own life.

For that reason, it’s useful to have someone to whom you can say: “I just moved from 6 digits of debt to 5 digits. I can’t believe it!!! “ and for them to give you a high five.

We all need a cheerleader in life.

3. A Willing Partner

If you have a spouse, they need to be on board with this. It can still work without them but, it’s difficult.

Like the saying goes: You can lead a horse to water, but getting a sponge bath from them is a different story.

Wait… maybe that’s a different quote.

You get my point.

Don’t drag your spouse along; make sure they are a willing partner on this path.

My wife and I got out of debt in 7 years because we both bought into this goal as a team.

There will be challenges. Working to become debt free together will make you a stronger couple and give you a bond that few others will have.

If you’re interested in what it is like now that we are debt free, you can read this post here.

Paying off debt is all about persistence. Stick with it; it’s worth it in the end.

The Steps to Getting Out Of Debt Fast

Knowing how to get out of debt is pretty simple, but sticking it out is the hard part. Get around people that are doing the same thing.

The steps to getting out of debt are easy. Anything written down is easy (everything seems to be “3 easy steps” lately), what’s hard is sticking with it.

It’s hard not to reach for your credit cards when you want something you can’t afford.

It’s difficult to hold back from going on a holiday when everyone you know seems to be heading somewhere over spring break.

Been there, done that; or didn’t do that as in the case of going away on spring break.

So here is the way we got out of debt, including our paid off mortgage.

Where Do You Start to Pay Off Your Debt?

Let’s accept a truth before we do the most important step.

Let’s accept that we are at blame for our debt. Whether it was a bad choice, an accident out of control or something else. It’s time to stop blaming the world and take control.

Let’s assume responsibility and make a commitment right now to becoming debt free.

I’ll go first:

“I, Andrew, am responsible for the debts I incurred, and I am committed to paying them off once and for all.”

I feel better. Now you go.

Go ahead and do the same.

It’s ok. It’s empowering.

All done? Great. Let’s get this done!

Step 1: Gather Up All Your Debts

You need to gather up all your debts. You can’t start to be debt free until you know how many debts you have.

And yes, include your mortgage in this because a mortgage is a debt.

Side note: I don’t understand why mortgages get a special place. Debt is debt, and it all needs to be repaid at some point.

Once you have all your debts, write down the following:

- How much you owe

- How often you pay them

- The interest rate

- Your payment

- What kind of debt it is

- What institution the debt is with

These are going to be important in the following steps.

Enter them into this spreadsheet here. That way you will get a good idea of all your debts in one place. When you are done it will look something like this.

Step 2: Figure Out Why You Have These Debts and Remove Any Obstacles

This sounds like a funny thing to do. But give it a few minutes of your time.

Take for example your credit card debt. Did you buy a whole bunch of sh…er…stuff to make you feel better in the moment? Now you’re left with the debt and feeling worse.

You aren’t alone with this.

Debt is borrowing from tomorrow so you can enjoy today.

Guess what? When tomorrow comes, future you won’t be any happier.

In fact, right now you are a version of “future you”. And I’m guessing you aren’t exactly thrilled with the debts you have.

Been there, done that, and you aren’t alone.

The truth is that years ago you traded tomorrow for today.

Now that tomorrow has arrived, I want you to realize what you have done so you don’t make the same mistake again.

The big reason for doing this step is to find out if you’re putting yourself in debt with bad spending habits.

If you go out and spend when you feel less than great, know that and own it. You need to be aware of that and decide how you will combat those feelings.

If you find yourself spending more than you can afford, then you need to get these things out of your life until you are debt free.

This includes credit card debt or lines of credit.

Get rid of them now.

Once they are out of your life and becoming debt free happens, you can reassess once the debt is gone.

Step 3: Decide If You Should Refinance and/or Consolidate Your Debt

Oh, this is always a tricky one.

On one hand, refinancing can be a great tool. On the other, it can be the dumbest thing you will ever do.

So let’s clarify this a little bit.

If you are serious, and I mean truly serious, about burying your debt habits once and for all then debt refinancing can be great.

But if you are going to refinance and then go back and start spending again, then you should run away from debt refinancing as quick as possible.

Like you need to treat refinancing debt like it’s Pennywise the Clown from the movie IT, you need to get away FAST!

What are the pros of refinancing?

If you have any high-interest debt, refinancing can help you out big time. Getting a lower interest rate on your debt is like getting a shovel to dig a hole when all you had before was a spoon.

Take a look at your debt and then take a look at sites like Lending Tree then decide if it’s worth doing.

What about consolidating my debt?

If you are going to refinance, consolidating your debt will also be on the table.

There are two thoughts on this.

1. When you consolidate, all your little loans get paid off, but you still have access to them. So you need to make sure that doing this is the right move and close them out.

2. When you consolidate all the money goes into one big debt hole and you are in charge of filling it up with money.

For some people, it feels easier to attack each debt on their own one by one. For others, it’s easier to put it all together in one place.

If you are thinking about debt consolidating then you can check out Lending Tree

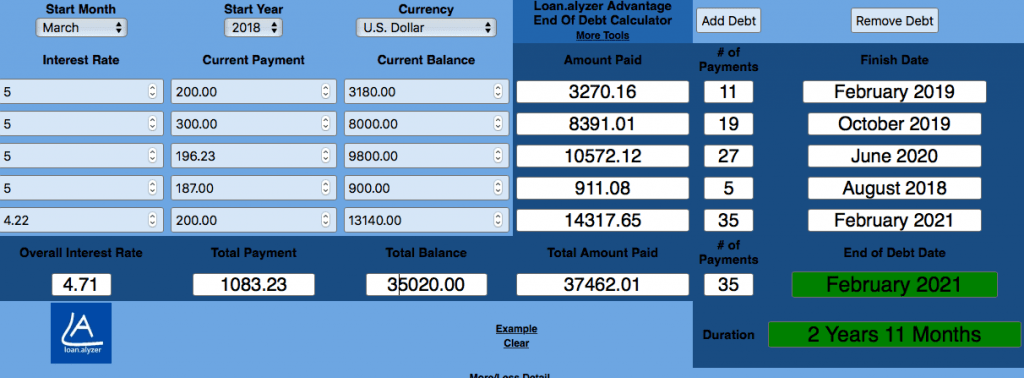

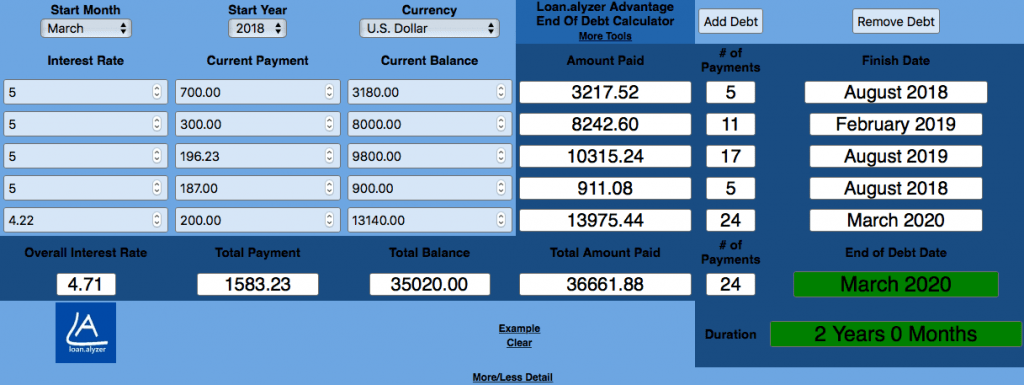

If it were me in this example above, I would see about refinancing anything above 6%. Depending on the rate you can refinance at, this may be your best choice. Let’s say we can refinance everything down to 5%.

It would cut out a month of payments and save over $1,300 just by doing that.

Step 4: Decide on Which Debt Repayment Method is Best For You

Now that we have your debts in order, it’s time to decide what your plan of attack will be on your debt.

Here are the two most common methods.

Debt Snowball

The debt snowball is a method of paying off your debt where you go after the smallest debt first.

That way you can pay off something fast and gain some momentum. This has been an effective way for thousands of people to pay off debt.

Pros: Great for the quick win and gaining momentum.

Cons: You will likely pay more in interest over the life of it.

Debt Avalanche

This method involves you paying down your highest rate of interest and paying it off first. The positive of this one is that you are being money smart and getting rid of your highest interest rate first.

The downside is that this can take longer and you don’t get the wins as fast.

Remember that logic doesn’t play into our money all that often (if it did we wouldn’t have gotten into debt in the first place).

So it’s a good idea to do the one that makes the most sense both financially and emotionally.

Personally I prefer this method; it’s better for your money and it resonates better with me.

Step 5: Come Up with a Minimum Monthly Debt Repayment Amount

This is key, think of it as a floor. This is the bare extra amount you are going to put down every month on one of your debts.

It should be larger than what you are already putting down (otherwise you won’t get out of debt quicker). Look at your finances and see what you think you can put down as a minimum.

Let’s say in the table our friend decides to add an additional $500 a month on to their debts (we will get to how he finds this extra a month in the advanced steps).

The worksheet shows that it will cut down the debt pay off timeline by 11 months.

Step 6: Get Comfortable With a Debt Payoff Calculator

Now you have all your debts together. You’ve decided which is best for you (consolidating or refinancing) and picked a method to pay it off (debt snowball or debt avalanche). It’s time to set a timeline.

Meet your new best friend.

It’s a debt tracker. There are a few on the market.

Personally, I love this one. Because it’s free, and you’re paying off debt, and free is always a good thing.

This will give you a good idea of where you are at with your debt and what you can expect for your debt timeline.

Plus, you can play with the payment amounts and see how things change. It’s free and it’s great!

Once you play with this you will have a timeline. Play around with this calculator and change the amounts until you find something you can handle.

Check out this debt payoff calculator to get you you started.

Step 7: Pick a Debt Freedom Date

A birthday without cake is just a meeting, and a goal without a deadline is just a wish.

Use the calculator to come up with your debt-free date. Set it as a goal in your mind. Start thinking about this date and how good you feel once you arrive at destination debt freedom.

Step 8: Pick Your First Debt And Go After It

This is where the rubber hits the road. No matter where you are in your debt journey pick that one debt and start paying it off while you make the other required payments on the other debt.

Attack that debt like your life depends on it. Every time you put money down on it pat yourself on the back.

Give your spouse a high five and be proud for being proactive.

Once you have destroyed the first debt go after the next one. Don’t jump around. Focus on one and put what you can against the one you are working on.

Give it all you got. Once that first debt is paid off pick another one and go after it.

Step 9: Work the Plan Until You’ve Paid Off Your Debt

Now that you’re on the debt freedom yellow brick road your only job is to keep at it. This last step in the basic plan (we will get to the next level stuff in a moment) is the longest and the most challenging, but you can do it!

Here are a few tips from paying off debt in 7 years.

1. Celebrate Milestones

When you are paying off debt, it’s a marathon, not a sprint. So make sure you have some celebrations in place (these shouldn’t involve going into debt).

By going through this you are going to need to celebrate wins. You could deny yourself until you are completely debt free, but that rarely works.

Speaking from someone who is debt free, life is still going on while you do this.

Make sure you enjoy it.

2. Forward Momentum is More Important Than Perfection

You’re going to have something come up that will trip up your debt repayment plan.

Deep breath. It’s ok.

Just do something. Anything is better than nothing.

When you’re paying off your debt you want to feel like you are always making progress.

So put $1 down if you can’t manage anything else.

I did it, and it felt better than I thought it would. Because I was keeping on, keeping on.

This is a marathon.

You’ve got this!

3. Remind Yourself Constantly Why You’re Doing This

Come up with a mantra; ours was “Debt free in our thirties”. We reminded ourselves that this was a big part of Operation Financial Freedom.

We knew that getting debt free and owning our house outright meant more options. It meant being able to quit our jobs and take lower paying ones if we wanted to.

It meant being able to take leaves and travel without guilt. There are a lot of benefits of being debt free. You need to remind yourself of them because it’s important.

4. Get Obsessed With Your Debt…But In a Good Way

Every person I have talked to who paid off their debt faster than normal got obsessed with the idea of being debt free.

They thought about what it would mean to them.

They dreamed of how life would be when they paid their debts off and made it a priority.

If you are wanting to get out of debt faster, then getting a bit obsessed with it can be a great thing.

Advanced Level for Paying Off Debt Faster: What You Can Do to Become Debt Free Faster

After a few months, (or days if you are like me) you are going to start thinking about ways you can accelerate how you can get out of debt.

This is where the fun begins.

Because you could keep going with the plan you have above. But if you have made it this far, then you are an achiever and debt freedom can’t come fast enough.

Let’s talk quickly about a small number.

That number is 30, as in $30 a day. If you can find a way to cut out $30 a day in spending, or better yet, find a way to add $30 to your income, you will make $900 extra a month.

That’s over $10,000 a year!

$30 a day is a big deal.

There are a lot of ways to make this happen. But they fall into two main categories.

Step 10: Track Your Spending

Ok, so once upon a time there used to be pen and paper for tracking your money. Fast forward and there are tons of apps many of which can do this for free. Here are the most popular ones:

Usually, when you start tracking your money you can go back a few months and see how things are going. If you aren’t up for that just start tracking your money going forward. This will be key in the upcoming steps.

Mint guesses where your spending categories go, Tiller can be set up for it. Doesn’t really matter what you use, but make sure you are tracking every cent you are spending. It’s key to becoming debt free faster.

Step 11: Go Over Your Spending and Decide What Spending Can Wait

After you have been tracking your spending for a few months (likely a lot sooner) you will want to make a few decisions.

You see friends, paying off your debt faster means that some things have to change.

I know, I know. You don’t like change any more than anyone else, but if you keep doing the same thing, you will keep getting the same results.

Just to be clear, those same results are more debt.

Which means more unhappiness.

And that means living in a way that doesn’t make you happy.

Just sayin’.

Decide which of the items in your spending are going to get cut out all together and which ones can be reduced (sometimes drastically).

Here are some ideas to get you started:

- No more trips (learn how to enjoy a stay-cation)

- Drive your car until it dies

- No more eating out (except when we hit our debt pay off goal for the month)

- No more… (insert whatever just came to mind here)

Whatever you choose, make sure you and your spouse are both on board.

Don’t come in heavy handed with your spouse one day and announce: “We are no longer washing our clothes so we can get out of debt faster.”

That won’t go over well.

Talk with your spouse and see what you are willing to sacrifice in the short term so you can live an amazing life in the long term.

Don’t get me wrong you can get pretty extreme with this and I encourage you to think about what’s really important.

Debt free living is amazing and the quicker you can get here the better.

Just realize life is happening along the way and your decisions aren’t just impacting you most of the time.

Debt Free Tip: If you are having a hard time with this whole sacrifice thing, set up an allowance for each of you to spend. That will keep you happy when you feel like you are depriving yourself of things.

If you want to see the things we gave up to become mortgage free you can see them here.

Step 12: Look For Ways to Save Money on Day to Day Items

I always think of my money like it’s in a bucket. That bucket has leaks, so money is constantly seeping out of it to different places. Because I really want to plug my money bucket I’m always looking for ways to stop money seeping out of my life.

To help you out with plugging your money bucket, I have created a weekly email that will give you one money saving action step you can do for the week. This will put more money in your pocket, or stop it from seeping out.

The truth is that little things add up when you are saving money. Saving on the big items is important. But so is making the small changes that can add up quickly over time.

You can check out our money saving ideas here.

I strongly recommend that you sign up for our weekly Money Saving Action Steps. It’s one email a week that will show you a way to save money. That way you can put it into place and keep going on with your debt pay off plan.

Step 13: Make More Money

Side hustles are big when you are paying off debt. There are a lot of them you can do. A few are:

- Part time jobs

- Uber Driver (check out this post on how to get started)

- Rent out a Room with Airbnb (here’s 15 things you should know before you start renting out with Airbnb)

- Uber Eats (check out this post on how to get started as an Uber Eats driver)

- Rent out your stuff with Fat Lama

- Dog walker

- Start a blog (this takes longer to build but the rewards can be huge, check out our free mini course)

You can check out more money making ideas here.

The key here is to remember that you can try these side hustles out even once and if you like them you can do it more and more. If you don’t like them you can stop.

But the important thing to remember is that they are means to an end. They aren’t a forever thing (unless you want them to be).

By earning extra money you will naturally speed up the debt freedom process.

Side note: One of the unexpected advantages of a side hustle is that you are too busy to spend money. So you ramp up your plan even faster than you might expect.

Are you ready to start your debt free journey?

I have dropped a ton of info on you and I want you to know that this journey is worth it. If you are ready to take the first step, sign up for our emails and get this post sent to you.

I’ll send you a couple of emails so you can get your debt free plan ready and then you will get our weekly Money Saving Action Steps so that you can plug your money bucket and get debt free faster.

Commonly Asked Questions About Getting Out Of Debt

How extreme should I be?

It’s up to you. Some people sell their stuff and house and move into a smaller place. Others rent out their house and rent a smaller place. Some people work a lot to get debt free fast. It’s up to you.

There is no wrong path here.

What if something changes?

That’s life, change with it. Your ability to adapt is key to making this work.

What about investing?

I’m not an investment advisor but I do believe that investing is important. You will need to decide what the right balance is between paying off your debt and investing.

Personally, I would wait until all debt is gone (besides mortgage) to start investing. If you are paying high interest rates on your debt, then investing doesn’t make sense.

Got other questions? Leave them in the comments below and I’ll do my best to answer them.

How to Get Out of Debt Action Steps:

- Get around other people who are becoming debt free (join our Private Facebook Group)

- See if refinancing is the right thing for you to do

- Pick a debt repayment method (snowball or avalanche)

- Look for ways to save money

- Look for ways to make more money

- Pay off your first debt and keep after all of your debt until done

Looking for more get out of debt reading? Make sure to check out:

Debt Free Living – Is it worth it? What’s it like?

28 Things We Gave Up To Become Mortgage Free

6 Mistakes We Made Becoming Mortgage Free

Our Paid Off Mortgage Story – How We Crushed a $320,000 Mortgage in 6 Years

Did you found this useful? Help others find it by sharing it.

FREE Ultimate Guide: How To Get Out Of Debt

Sign up for our weekly emails and we will send you our guide to becoming debt free and other useful resources to help you with your money.

This was a very thorough and detailed post, Andrew! Thank you for sharing it. I will definitely refer to this the next time someone asks me what they can do to get out of debt. You could almost write a book just from this one post. Have you thought about that?

Thanks Scott! I would love to write a book on getting out of debt. If I can do anything to help others get to a debt free life I’m all for it.

Hi Andrew, great post! I’m already doing a lot of things on this list, but I find it really helpful to keep on top of things by checking what others are doing and remembering i’m not alone! I can definitely tighten my belt a bit more; after a year of being pretty intense about it, I’ve slackened off slightly, but need to focus again. My debt freedom date is my birthday in November – I want to be debt free by then 🙂

Hey Lee! That is an awesome goal to have. Debt free on your birthday would be sweet! You can do it!!!